EUR/USD

The Euro found solid support in the 1.30 area against the dollar on Tuesday and initially pushed to highs around the 1.3080 area with an extension of gains during the New York session as it peaked around 1.3130 with a covering of short positions.

There was initial relief surrounding the German IFO index which recorded an increase to 107.2 for December from 106.6 previously, the second successive month that it confounded expectations of a decline. The Institute was cautious over the outlook, but there was relief that deeper pessimism was avoided.

The latest Spanish bond auction was stronger than expected as yields fell with strong bid/cover ratios which helped maintain the trend towards lower peripheral bond yields. There was further speculation that banks were buying bonds and there were also expectations that there would be very strong demand in the first ECB 3-year repo operation on Wednesday where banks can bid for unlimited funds. Markets suspect that very strong demand for funds would again translate into bond buying which would also ease Euro-zone fears, at least in the short term.

The latest US housing data was stronger than expected with starts rising to the highest level since early 2010 at an annual rate of 0.68mn while the permits data was also stronger than expected which maintained cautious optimism towards the housing sector. There were concerns over continued congressional wrangling surrounding the extension of payroll tax cuts, but underlying risk appetite was still firmer which dampened defensive demand for the dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar rallied briefly back to the 78.0 area against the yen on Tuesday, but it was unable to sustain the gains and dipped back to test support below 77.75.

The US currency failed to gain any significant support from the stronger than expected housing data which will cause some concern over underlying US currency demand, especially as the underlying data has maintained a consistently solid tone.

The latest Japanese trade data recorded another deficit for November and there was a further decline in exports with the second successive annual decline with a 4.5% annual retreat. There was a recovery in shipments to the US, but Asian demand was weaker.

With suggestions that the Japanese government is increasing its intervention fund, there will also be speculation over action to sell the Japanese currency and this may discourage yen buying.

Sterling

Sterling pushed sharply higher against the US dollar with a peak around 1.57 as the US currency retreated and the UK currency gained support from improved risk appetite.

The latest GfK consumer confidence reading remained stuck close to record lows with a December reading of -33. In contrast, the CBI retail sales survey was much stronger than expected with a recovery to 9 from -19 previously, although retailers were very uneasy over January’s outlook.

The data injected a further note of uncertainty into debate surrounding the economic outlook and there was also a high degree of uncertainty surrounding the impact of bank restructuring. There was a further suspicion that lending levels would be damaged which would undermine growth prospects.

Although ratings agency Moody’s stated that the UK AAA credit rating was safe for now, it did warn that the Euro-zone stresses would have an important negative impact which would also make it more difficult for the UK to absorb any further shocks.

The Bank of England MPC minutes will be watched closely on Wednesday amid expectations that the bank will continue to signal further potential action in February once the current round of bond purchases has been completed, as hinted at by MPC member Bean in comments on Tuesday.

Swiss franc

The dollar was unable to make any headway against the franc on Tuesday and retreated sharply to lows below 0.9275 before some stabilisation around the 0.93 area as there was choppy Swiss trading against the Euro.

The latest trade data was stronger than expected with a CHF3.00bn surplus for November, although there was a slowdown in export growth.

Liquidity will continue to deteriorate over the next 48 hours and this will maintain the potential for erratic trading conditions. There will also be the potential for further verbal intervention by the central bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

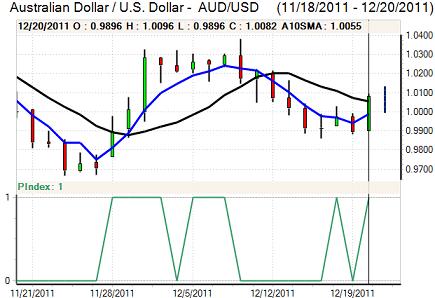

Australian dollar

The Australian dollar maintained a firmer tone during Tuesday and a break above the parity level triggered a further strong advance to the 1.0080 area with fresh highs around 1.0130 during the Asian session on Wednesday.

There was a significant improvement in risk appetite as equity markets rallied which helped underpin the Australian currency.

There were still underlying doubts surrounding the Asian economy and there was also evidence of longer-term structural flows out of the currency which may dampen sentiment.