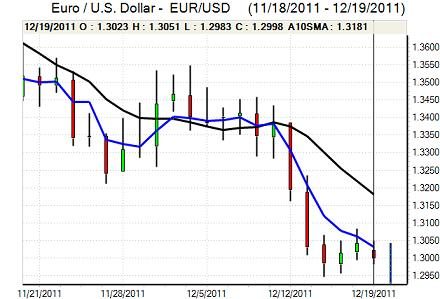

EUR/USD

The Euro was trapped within narrow ranges on Monday as there was an underlying lack of confidence in the currency, but a reluctance to push it sharply weaker given the pressures for a correction and the number of existing speculative short positions.

There was a tele-conference of European Finance Ministers as they continued their battle to restore Euro-zone confidence. The amount of potential funding to the IMF was cut to EUR150bn and there was no evidence of significant progress in other policy areas. There was a weaker than expected Euro-zone current account figure and further net capital outflows for October.

ECB president Dragi maintained his stance on bond purchases, reiterating that they were a temporary and not infinite. Although the ECB did increase its bond buying in the latest week from very lows levels in the previous reporting period, Draghi was again very anxious to play down the possibility of further monetary support for the peripheral economies. The key fundamental problem for the ECB is that could only consider the possibility of further monetary support if individual countries make the necessary fiscal reforms. In this context, the ECB will have to maintain a tough tone to keep the underlying pressure on, especially given the amount of internal opposition to the buying programme.

The US HAHB housing index rose to 21 for November from a revised 19 the previous month, maintaining a slightly more optimistic tone towards the US housing sector. There are hopes that housing and construction will be able to make a positive contribution to growth during 2012, although the sector is far from healthy. There was also further unease surrounding US budget policies as there was no progress on extending tax breaks beyond the end of 2011.

The Euro found support on dips to the 1.2980 area with gains blocked below 1.3050 given caution over the risk of further credit-rating downgrades.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar drifted slightly weaker against the yen on Monday, but losses were very limited as ranges remained extremely narrow with overall consolidation close to the 78 level.

Markets continued to watch the North Korean situation closely following the death of Km Jong-il with inevitable concerns surrounding the nuclear programme under a new leadership. The yen only spiked very briefly on reports of a Korean missile test-firing and the overall impact was still subdued.

There is still little incentive for Japanese funds to move aggressively into overseas bond markets, especially with benchmark yields at extremely low levels which will maintain the risk of capital losses. A lack of outflows will limit the potential for yen depreciation.

Sterling

Sterling found support on dips towards the 1.5470 area against the dollar on Monday and tested resistance in the 1.5550 region, although attempts at breaking through were generally half-hearted, particularly with the market as a whole very subdued.

Bank of England MPC member Fisher voiced concerns over the economic and financial outlook with a warning that conditions could be even worse than those seen in 2008. There will be further unease over the UK outlook, especially if there is renewed pressure on lending. A UK rejection of increased funding for the IMF will tend to maintain political stresses.

There was some relief in the latest Nationwide consumer confidence data which rose to 40 for November from a record low of 36 previously, although underlying sentiment was still extremely fragile amid high uncertainty over spending trends at a critical time of the year.

Swiss franc

The dollar found support in the 0.9350 area against the franc on Monday and edged slightly higher, although there was no move to challenge the 0.94 area. The Euro found tentative support below 1.2180 against the Swiss currency. The franc did not gain any major support from the North Korean uncertainty given its reduced status as a safe-haven.

National Bank president Hildebrand continued to warn that the bank would do all that it can to defend the Euro minimum level and there is likely to be further verbal intervention to keep any speculative franc buying at bay in the short term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar was unable to break back above parity against the US currency on Monday and was subjected to fresh selling pressure with a decline to lows below 0.99 late in the US session.

There was a tentative recovery in Asia on Tuesday with an increase in buying support following the Reserve Bank minutes. The minutes stated that there had been reasons to leave interest rates on hold and that the major reason for the cut was fear over the Euro-zone situation.

There was still a mood of caution surrounding risk which curbed any aggressive buying for the local currency.