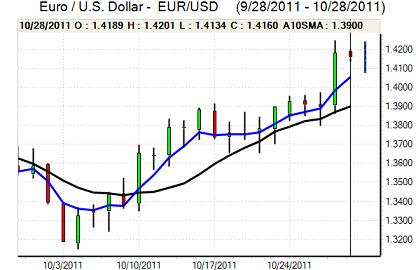

EUR/USD

The Euro was unable to break above the 1.42 level against the dollar on Friday and generally drifting slightly weaker in narrow ranges with a test of support in the 1.4120 area as markets continued to reflect on Thursday’s EU Summit.

There were significant reservations surrounding the agreement as markets focused on key elements within the package. Ratings agency Fitch stated that plans to increase the ‘voluntary’ Greek haircut to 50% would be a default which undermined confidence, although uncertainty remained very high as the ISDA appeared to indicate that CDS payments would not be triggered. There will be increased fears that private-sector banks will reject participation in the deal.

The latest Italian bond auction was weaker than expected as benchmark 10-year yields increased to above the 6.0% level. The poorly-received auction increased doubts over Italy and this was an important negative element for the Euro as a whole given Italy’s pivotal position within the Euro area. There will also be some concern that dollar Libor rates continue to increase despite the EU Summit which suggested that there were still important market tensions.

The US economic data did not have a major impact on Friday with a consumer spending increase of 0.6% in line with expectations, although the weaker than expected outcome for incomes will cause some concerns. There was an upward revision to the University of Michigan consumer confidence index.

The Euro weakened sharply in European trading on Monday as dollar buying on the yen helped push the dollar higher on the crosses and there was also some further negative sentiment surrounding the Euro-zone with a decline to the 1.40 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any significant headway during Friday and drifted weaker with a test of record lows near 75.50 against the Japanese currency.

There was a rapid dollar move higher in Asian trading on Monday as a US decline to record lows finally triggered action by the Finance Minister. The Bank of Japan intervened aggressively in the market with large-scale yen sales. The Japanese currency weakened sharply to lows near 79.50 during the session which was a three-week high for the US currency.

The Finance Ministry warned that there would be further action if necessary which will curb immediate yen buying. The evidence suggested that intervention was unilateral and there were no co-ordinated moves by G7. There is still likely to be some speculation that there will be wider moves to stabilise currencies.

Sterling

Sterling found support on dips to the 1.6080 area against the US dollar on Friday and maintained a generally firm tone with gains to fresh 7-week highs near 1.6150 during the US session.

The latest UK data will be watched very closely this week with a particular focus on the PMI data following stronger than expected data last month. If there is another stronger than expected batch of readings, there will be speculation that the actual economy is proving to be more resilient than expected, in contrast to generally pessimistic rhetoric from the Bank of England.

The banking sector will continue to be an important focus as Sterling will be vulnerable to renewed selling pressure if the Euro summit fail to provide durable relief to the financial sector.

The Bank of Japan intervention dominated on Monday as a wider US recovery push Sterling back to below the 1.60 level against the US currency.

Swiss franc

The dollar was generally on the defensive during Friday and was unable to move back above 0.8650, although there was support on dips towards 0.86 with Euro support below 1.22.

The KOF business confidence indicator weakened sharply to 0.80 for October from 1.21 previously, the lowest reading since August 2009 and the rate of decline will certainly maintain fears surrounding the economy and will also sustain pressure for franc gains to be curbed.

The Bank of Japan moves to weaken the yen could increase demand for the Swiss currency on defensive grounds, although there will still be strong expectations that the National Bank will keep control in the near term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

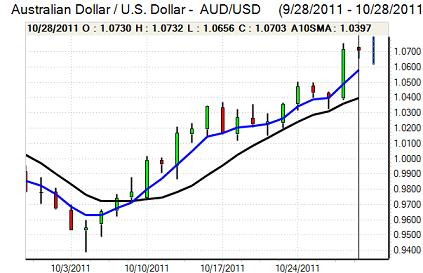

Australian dollar

The Australian dollar maintained a firm tone during Friday, but there was resistance above the 1.0720 area against the US currency as momentum faded following a sharp rally.

The domestic data did not have a significant impact on Monday as there were modest gains for private-sector credit. The Reserve Bank meeting will be very important on Tuesday and the currency will be vulnerable if there is a cut in interest rates.

The Australian dollar dipped sharply during Asian trading on Monday and there was a test of support near the 1.05 level as the US currency secured a wider recovery.