EUR/USD

The Euro probed resistance levels near 1.3950 against the dollar in European trading on Tuesday, but was unable to break higher as volatility also remained an important feature during the day.

In a draft section from the EU Summit agreement there were references to the ECB continuing to adopt non-standard measures to provide market liquidity. The German government immediately issued a press release stating that they did not agree with this which increased market tensions, especially as the German authorities also held firm on using the ECB to fund the EFSF.

There were further important stresses surrounding the Italian economy as the government failed to agree pension reform measures which are seen as crucial for providing greater confidence to the markets. There was also further tensions surrounding the Greek bailout package as private bond-holders looked to resist ‘voluntary’ haircuts of at least 50% and the economy remained on the brink of default.

Volatility spiked again in US trading as there were reports that the ECOFIN meeting also scheduled for Wednesday had been cancelled. There was some initial confusion with fears that the actual Summit scheduled for later on Wednesday had been postponed. Once these fears subsided, there were also fears that there were greater than expected policy differences which would block any resolution on Wednesday.

The US economic data was weaker than expected as consumer confidence dipped sharply to 39.8 for October from 46.4 the previous month. This was the lowest figure since March 2009 and increased fears that the economy was sliding back towards recession even though recent data had been slightly more encouraging.

The Euro retreated to lows near 1.3850 on fears over a Summit cancellation before correcting back to the 1.39 area as there was still solid buying support on dips even when risk appetite was generally weaker.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was subjected to renewed selling pressure following the weaker than expected consumer confidence data as yield support was subjected to fresh pressure and there was a fresh deterioration in confidence surrounding the economic outlook. The dollar dipped to record lows close to 75.70 before regaining some support later in the US session.

There was fresh speculation that the Finance Ministry would order intervention through the Bank of Japan and there were also renewed market rumours that the central bank would take additional action to loosen monetary policy at Thursday’s monetary policy meeting. This speculation curbed aggressive buying, but the yen maintained a robust tone.

Sterling

Sterling continued to probe resistance levels above 1.60 against the dollar during Tuesday as underlying sentiment remained slightly stronger and it proved resilient in the face of fresh doubts over international risk appetite.

The domestic economic data was mixed as there was a weaker than expected figure for mortgage approvals which fell to a 5-month low. In contrast, there was a much better than expected current account figure with the quarterly deficit held to GBP2.0bn from a revised GBP4.1bn previously. Although the data is volatile, there was some optimism that the UK funding environment was not as bad as expected.

There was also support from a deterioration in confidence surrounding the other main economies with Sterling’s relative performance seen in a more favourable light. Sterling held just above 1.60 against the US currency later in the US session, although volatility is liable to spike higher again.

Swiss franc

The Euro was generally unable to make any headway against the franc on Tuesday and edged weaker to the 1.22 region during the US session. The dollar also remained generally on the defensive as it tested support below the 0.88 level.

There were no fresh comments from the National Bank on currencies and uncertainties surrounding the Euro-zone bailout measures were important in curbing underlying selling pressure on the franc. There was still little enthusiasm for buying the franc aggressively given fears over triggering a central bank response.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

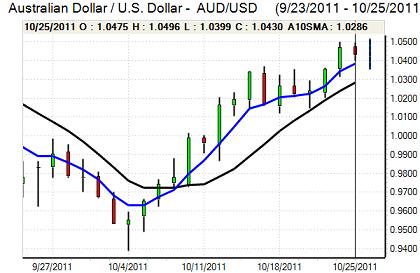

Australian dollar

The Australian dollar continued to probe resistance levels in the 1.05 area in Europe on Tuesday, but was unable to break through. There was a fresh spike in volatility during New York trading as the Euro fluctuated sharply and the Australian dollar dipped to lows near 1.04 before regaining support. Although global risk appetite has generally stabilised, confidence is liable to prove very brittle given the underlying stresses.

Domestically, the third-quarter inflation data due for release on Wednesday will be extremely important for interest rate expectations and a weaker than expected figure would ensure strong pressure for a Reserve Bank interest rate cut at the November policy meeting.