EUR/USD

The Euro hit resistance close to 1.3950 against the dollar in early Europe on Monday and dipped to lows near the 1.3825 area during the European session. The Euro-zone PMI impact was mixed, butt he overall tone was negative as both the manufacturing and service-sector indices weakened to below 47.5 which was the lowest level since the third quarter of 2009.

Following Sunday’s Summit meeting, European leaders continued to discuss options surrounding the Euro-zone sovereign-debt crisis. There are plans to raise EUR108bn in fresh capital for the banking sector with the banks forced to raise capital first and there will be government support for banks that are unable to raise sufficient funds. There will of be fears over moral hazard as there may be little incentive to raise funds. There was further speculation that there would need to be Greek debt write-downs of 50-60%, although there was resistance from private bondholders.

With regards to the EFSF funds, the German parliament will be allowed a full vote on measures to expand the fund. EU leaders are still considering plans to boost the fund through leverage as Germany failed to sanction any use of the ECB to provide financing.

There was a particular focus on the Italian debt profile with increased fears surrounding the Italian economy with fears over the EUR1.9trn debt burden. Prime Minister Berlusconi called an emergency cabinet meeting to discuss austerity measures as market confidence remained extremely fragile as the ECB continued to buy peripheral bonds.

There were further financial stresses within the banking sector as dollar Libor-OIS spreads rose to two-year highs and there was also a renewed increase in Euribor rates while credit quality continued to deteriorate.

Fed Governor Dudley maintained a generally dovish tone in comments on Monday, but he did not suggest immediate quantitative easing. Underlying speculation that there could be further Fed action did limit any support for the dollar

The Euro recovered from lows before rallying back to test 6-week highs in the 1.3950 area later in the US session as risk appetite continued to improve with resistance still strong in this region as underlying doubts persisted.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make significant headway during Monday with tough resistance towards the 76.50 area and there was a further test of support in the 76 region.

There was no additional yield support for the dollar during the day which stifled US currency buying.

Although there was some net improvement in risk appetite, the yen was broadly resilient during the session with Japanese funds still unwilling to contemplate capital outflows.

There was further speculation that the Bank of Japan would take action to weaken the Japanese currency and there was solid dollar buying support at lower levels, but there was also evidence of a heavy positioning bias which stifled rally attempts.

Sterling

Sterling hit resistance close to 1.60 against the dollar in Europe on Monday and initially retreated to test support in the 1.59 area as there was a wider reprieve for the US currency.

There were further serious concerns surrounding the domestic economy as incomes remain under pressure which will put additional downward pressure on spending.

There were further uncertainties surrounding the impact of quantitative easing, but the immediate impact on Sterling was limited as the currency was supported by a general improvement in risk appetite. There was also relief, for now, over last week’s budget data as any sustained improvement would lessen the short-term risks of a credit-rating downgrade.

Swiss franc

The Euro was unable to make a move above the 1.23 level against the franc on Monday and dipped to test support towards 1.2250 later in the US session. The US currency was unable to gain any sustained relief during the day and tested support just below the 0.88 level.

National Bank President Hildebrand continued to warn that there would be decisive attempts to defend the 1.20 Euro minimum rate against the franc which discouraged aggressive franc buying, especially as there was a general improvement in risk conditions. There is still the risk of volatile trading surrounding Wednesday’s Euro summit.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

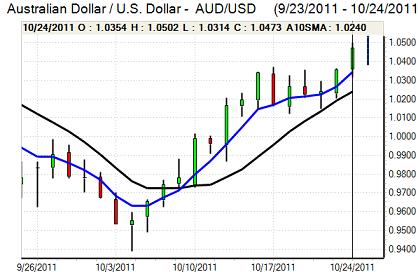

The Australian dollar maintained a strong tone during the day and continued to challenge resistance levels. There was a wider improvement in risk appetite which helped underpin the currency and there was a peak close to the 1.05 level before a limited correction. Asian currencies were also generally firmer during Tuesday which helped sustain support for the Australian dollar as relief surrounding the Chinese PMI data continued to have a positive impact.

Markets will be on alert over the inflation data due on Wednesday as this could have a decisive impact in the prospects for a near-term cut in interest rates.