EUR/USD

After consolidating above 1.34 ahead of the US employment data on Friday, there was fresh volatility during the US session.

The headline US employment data was stronger than expected with a 103,000 increase in payrolls compared with expectations of around 60,000 while the August figure was also revised up by over 50,000. There were monthly distortions in the data as returning strikers pushed the total higher and there was a disappointing figure for manufacturing employment. In contrast, there was a stronger than expected reading for construction. The consumer credit data was weaker than expected which may raise some fears over the spending outlook.

There was an immediate improvement in risk appetite following the data which undermined any defensive dollar demand and the Euro pushed to challenges resistance levels above 1.35.

Late in the European session, the Euro was undermined sharply by fresh turmoil within the Euro-zone. Moody’s downgraded Spain’s credit rating by two notches to AA- while there was a one-step downgrade to A+ for Italy. The downgrades increased market fears over a contagion effect from the European debt crisis. There were further fears surrounding the banking sector, especially with Italian banks more dependent on ECB funding.

There were also further political stresses surrounding the EFSF as one of Slovakia’s coalition parties continued to warn that it would not back ratification of additional powers. German Chancellor Merkel and French President Sarkozy held talks on Sunday in an attempt to reach a consensus over strengthening the banking sector. They stated that they had reached broad agreement on a plan to support the banks with details to be unveiled later in the month.

The latest IMM data recorded a small decline in the net long US dollar position, but there was still an increase in Euro shorts to a record level which may offer some degree of Euro protection. After dropping to test support below 1.34, the Euro rallied in Asian trading on Monday as markets put a positive gloss on the Merkel-Sarkozy plans.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar spiked higher against the yen following the latest US payroll data on Friday with relief that the headline figure was stronger than expected, but there was further tough resistance in the 77 area and the US currency drifted lower again late in the US session.

Underlying fears surrounding the Euro-zone financial sector continued to offer important yen protection, especially with speculation over persistent capital repatriation.

There was a measured improvement in risk appetite on Monday which dampened yen demand against the Euro as it weakened back to near 103.50 while the dollar remained trapped in narrow ranges.

Sterling

Sterling held comfortably above 1.5450 against the dollar on Friday and pushed to highs near 1.5550 in an immediate reaction to the US employment data. There was solid Sterling buying support on dips and the currency briefly pushed above 1.56 before being undermined by general Euro vulnerability.

The UK currency was continuing to gain some protection from the lack of confidence in the Euro-zone with further defensive demand for UK bonds. This support is still liable to be fragile, especially as fears surrounding the UK banking sector have also increased. The support from short covering could also prove to be very temporary, especially if there is further evidence of economic deterioration.

The move to additional quantitative easing could have some benefit in supporting the economy, but markets will remain highly sceptical over the UK outlook. There will be a further battle between absolute fears over the UK outlook and relative protection from a lack of confidence in alternative currencies.

Swiss franc

The dollar briefly dipped to lows near 0.9150 against the franc on Friday, but then recovered ground strongly late in the session and pushed to a high near 0.9280. The Swiss currency maintained a weaker the on the crosses as the Euro pushed above 1.24.

There were further expectations that the National Bank would push for fresh currency weakness in the short term and this had an important negative impact on the Swiss currency.

The banking sector will remain an extremely important focus in the short term and underlying Euro-zone vulnerability could offer some franc support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

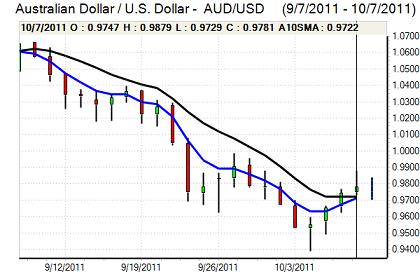

Australian dollar

The Australian dollar hit resistance above 0.9850 against the US currency on Friday and retreated to test support below 0.9750, although selling pressure was contained.

There was a more positive attitude toward risk appetite following the US payroll data which boosted Australian demand..

There were also fears surrounding the Asian economic outlook which sapped currency demand and volatility is liable to remain high in the short term as an improvement in risk conditions pushed the currency back above 0.98 in Asia on Monday.