by Jeff Friedman

The stock market’s early year optimism has faded, and major market averages have turned lower. Year-to-date, the S&P 500 is down about 9 percent, the Dow Jones Industrial Average is down 5 percent, and the Nasdaq 100 is down about 1 percent. Is the big bad bear market back?

We are clearly in a highly volatile environment. The CBOE market volatility index (VIX), often seen as a gauge of investor “fear” in the market, is trading at high levels. The VIX represents prices investors pay for protective options on the S&P 500 index. It moved above 48 in August (when S&P downgraded U.S. credit) and rose back above 45 early October.

What created the fear? We know we had problems with a potential Greek default and other debt struggles in the Eurozone. This was not new news and we seemed to cope with it. But then investors lost confidence in the U.S. economy after the Congressional debt ceiling debate debacle in the U.S. this summer, which resulted in a downgrade of U.S. credit by S&P in August. Then the labor and housing markets failed to recover as hoped in August and September, and investors began losing even more confidence, and the markets began to freeze up.

Some analysts have been forecasting a very dire situation for the market; round two of the 2008-2009 recession (the “double-dip”). Forecasters were changing their earlier projections for economic growth. According to a Bloomberg survey of 66 economists taken in March, U.S. GDP was seen at 3.3 percent in 2012. More recently, the survey showed a downward revision, to 2.2 percent.

The Technical Picture

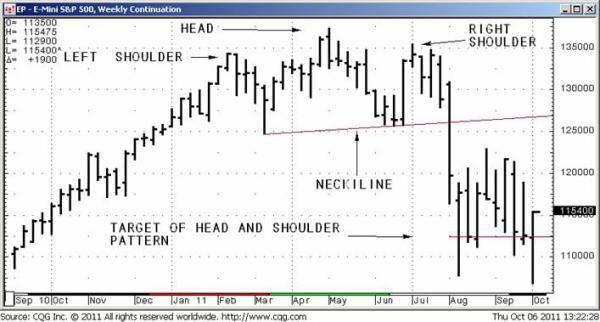

Let’s look at a technical picture for the S&P 500 futures. Right now, I see a classic head-and-shoulders pattern on the chart of the December contract. I believe this bearish pattern achieved its downside target at about 1,125, but the bottom of the pattern showed a large tail that pushed the market even lower. The market saw a very fast drop, moving under 1,100. However, that level has seen rejection, buying has come in at the lows, and to me, it looks like a bear trap.

What I think had happened in the past few months was that we had some bad news, and weak longs left the market. The stock market has been falling because people don’t want to invest in a stock if it’s considered overvalued, if dividends dry up, or if they think a company’s survival looks poor. All those and other factors might be taking place. We have a herd mentality in the markets right now, where investors flee all assets deemed “risky” (including stocks and many commodities) when bad economic or geopolitical news strikes.

So, are we in a bear market? A bear market would typically be defined as a close 20 percent off a market’s peak, which, in this case, took place in April. Technically, for December S&P 500 futures to fall 20 percent off that high, we’d see the market close around 1,075 – 1,080. The market has seen good support around 1,040, and right now, I think those levels should hold up.

Challenges in U.S. and Europe

We still face challenges in Europe and the U.S. and governments and central banks are still pursuing whatever options they can to cope. European bank regulators announced a new round of stress tests will be conducted to determine how much capital Eurozone banks would need should Greece default on its debt. However, I’m more optimistic than not the Eurzone will be on more stable footing by year-end.

At scheduled policy meetings Thursday, the European Central Bank and the Bank of England both decided to keep key short-term interest rates steady. However, the BOE announced further quantitative easing measures, boosting its asset purchase program by about $115 billion.

People still consider the U.S. dollar the safe-haven currency (despite our problems). As a result, the dollar has rallied in the wake of the European policy meetings. Further easing measures should continue to lift the dollar.

The biggest problem facing the U.S. right now is employment. We need job growth! Recent data on private job growth from ADP looked a bit better than expected, rising 91,000 in September.

On Friday, October 7, the U.S. Labor Department will release its September U.S. non-farm payroll report, which contains data on both private sector and public jobs. The consensus forecast among economists calls for an overall gain of about 60,000. Tthe unemployment rate is expected to stay steady at 9.1 percent. A disappointing report will likely push the S&P 500 past the support points I mentioned earlier. Keep in mind, increases from temporary holiday jobs should start to show up in the next few employment reports, so the numbers should improve.

September and October tend to be difficult months seasonally for the stock market, I don’t expect a severe market decline. China, the world’s growth engine, was tightening its money supply earlier this year to slow its racing GDP to levels it was more comfortable with. I think China is done tightening, as recent manufacturing data has shown slowing.

2011: Bullish, Bearish…or Neither

I’m cautiously optimistic the market will end the year relatively flat. In the coming months, we need some resolution from Europe’s debt crisis, and we need to create more jobs at home. A small decline for 2011 is possible, but I don’t feel it is the start of a bigger bear market cycle. If the December S&P futures close below 1,085 on a weekly basis, then I’d likely change my outlook. But right now, do I think we are entering a bear market? No. Do I think we are in a bull market? No.

These are my general thoughts and trading ideas at this point in time, and not to be taken as specific trading recommendations. These ideas may change at any time as conditions change in the markets. For more specific strategies tailored to your unique risk tolerance and goals, I encourage you to contact me.

Jeff Friedman is a Senior Market Strategist with MF Global. He can be reached at 866-231-7811 or via email at jfriedman@mfglobal.com. Listen to Jeff’s daily podcast and view archives of his monthly “Friedman’s futures webinar on our blog at www.letstalkfutures.com

(c) 2011 MF Global Ltd. 141 W. Jackson Blvd. Suite 1400-A, Chicago, IL 60604. 800-445-2000.