S&P500 Re-Cap 10-04-2011

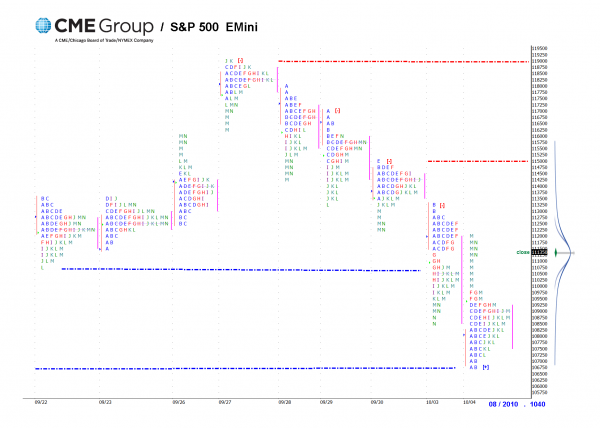

The S&P 500 opened at 1077.25, 9.75 points below the previous day’s settlement at 1087.00.

The S&P traded down to 1068 and then found support.

Responsive buying stepped in and bought price up through the range to fill the gap in C period and continued up to 1097.25 at/or near yesterday’s value area low.

Responsive selling at the 1097, turned to initiated selling, which auctioned price back down through the range.

Buying interest was again present and the S&P found support at 1072, L-period low. Responsive Buying turned to initiated buying and the S&P auctioned back up to 1086.

Selling pressure ended during M period. Previous short sellers covered their positions, initiating a short covering rally above the F-period high at 1097.25. Short covered positions up to 1119.75, 22.50 points above today’s F Period high at 1097.25. The M period rally was a one directional vertical move.

The market closed at 1114 yesterday’s sell off price, 27 points above yesterday’s close at 1087.00. We closed above today’s value area and within yesterday’s value area.

Support:

1106.50

1097.25

1091.75

1085.25

1072.50

1068.00

Resistance:

1119.75

1123.50

1126.50

1133.50

1138.50

1141.00

1148.00

To see more or join the LIVE trading room visit www.ioamt.com