EUR/USD

The Euro found support on dips towards 1.3425 on Friday and had a generally firmer tone during the day as there was a reluctance to sell aggressively ahead of weekend IMF and G20 meetings.

Underlying confidence in the Euro-zone economy continued to deteriorate and there was additional pressure for more decisive action at the meetings. There was continuing speculation that Greece would decide to default and there were further stresses in the Euro-zone banking sector as markets fretted over the burden of sovereign debt exposures and contagion threat in the event of a Greek default.

There were also increased fears surrounding the global economy and ECB President Trichet stated that systemic risks had increased.

At the meetings, there was a pledge to bring forward the EFSF replacement to 2012 from 2013 and there will also be attempts to boost the EFSF fire-power in the meantime. There will also be attempts to boost banking-sector capital. There was no Greek default, although the strong undertone of the message was that the plan was to let Greece default once the financial sector had been strengthened

After a very brief bounce at the market open, a lack of more definitive action pushed the Euro sharply lower in Asia on Monday with a test of support below 1.34. Markets were fearful that political constraints would undermine attempts to improve the financial position.

The latest IMM positioning data recoded the largest net long dollar position since July 2010 and a further increase in Euro short positioning which may lessen the threat of additional Euro selling.

Underlying confidence in the US fundamentals remained very weak, but there was further defensive dollar demand as emerging-market currencies also stayed under heavy selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 76.15 area against the yen on Friday and rallied sharply to a high near 76.90 during the US session, although there was no reported intervention.

There was no additional yield support for the dollar which sapped buying support and it dipped again during Asian trading on Monday.

At the weekend IMF meetings, there was no additional measures to weaken the Japanese currency and officials also stated that Japan was not in a position to pursue the same policy as Switzerland. This dampened speculation that there would be any concerted G7 action to weaken the yen.

The Japanese currency also continued to gain defensive support from risk aversion as underlying confidence in the global economy remained weaker and there were fears surrounding further equity-market declines with the dollar back near 76.30 on Monday.

Sterling

Sterling found support below 1.54 against the dollar during Friday and pushed generally higher with a peak just below the 1.55 level.

The UK BBA mortgage data was slightly stronger than expected which provided some degree of confidence surrounding the housing sector, although international developments remained dominant.

There were hopes that Euro-zone leaders would push towards a re-capitalisation of the banking sector and this would also provide some relief to the UK banks. Sterling also gained some support from its position outside the Euro area as any burden of supporting weaker Euro-zone members would not fall on the UK.

There were still very important reservations surrounding the UK economy with increasing pressure for additional quantitative easing by the Bank of England. Nevertheless, Sterling again proved resilient on Monday and advanced to near 0.8670 against the Euro.

Swiss franc

The dollar found support on dips towards the 0.90 level on Friday in slightly narrower ranges as the Euro was able to hold steady.

The National Bank in its quarterly report and speech by President Hildebrand repeated that the Swiss franc cap against the Euro would be defended with the utmost determination. There was a further reluctance to take on the central bank at this stage which curbed any franc buying support.

The Swiss banking sector remained an important focus due to the UBS trading scandal and unease over the huge size of banking-sector liabilities compared to GDP. Wider US currency gains pushed the franc to lows beyond 0.91 in Asia on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

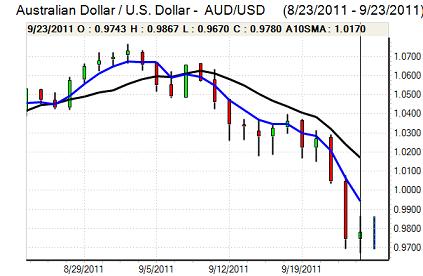

Australian dollar

The Australian dollar found support on dips towards 0.97 against the US currency on Friday and rallied to a high close to 0.9850 in very choppy trading conditions.

Confidence in the global economy continued to deteriorate, especially with increased fears surrounding emerging markets and this had an important impact in curbing demand for the Australian currency, especially as there was still pressure for a closing of previous long positions.

There was renewed selling pressure in Asian trading on Monday with a slide back to below the 0.97 level as markets continued to speculate that there would be a cut in domestic interest rates.