EUR/USD

The Euro initially found support below 1.38 against the dollar on Friday and attempted to rally, but was blocked in the 1.3850 area as fears surrounding the Euro area increased. At the Friday ECOFIN meetings, US Treasury Secretary Geithner called for a stronger policy response by European leaders and also suggested that the EFSF facility could be leveraged to give it greater firepower in boosting bond purchases.

There were increased political divisions within the Euro area and there were no major policy initiatives during the day. This pattern of events persisted as talks continued on Saturday with further friction within Germany. Chancellor Merkel’s CDU party attempted to stifle talk of a Greek default and Euro exit from the FDP party and CSU sister party from Bavaria, but underlying tensions persisted.

There were further uncertainties within Italy as Prime Minister Berlusconi remained under intense political pressure. The main focus was still on Greece as Prime Minister Papandreou cancelled a US trip in order to concentrate on the domestic crisis. There will also be a meeting with IMF and EU officials on Monday with the troika apparently making a fresh list of demands for immediate budget action in return for the next loan tranche including large-scale job losses in the public sector.

In this environment there were further fears that Greece could decide to default, especially as domestic political opposition continued to increase.

The US economic data offered no support to the dollar with a weaker than expected figure for capital inflows and only a tentative improvement in the University of Michigan consumer confidence index, although there were still defensive capital inflows. There will be further uncertainty ahead of Wednesday’s Federal Reserve decision.

Euro fears dominated in Asia on Monday as the Euro gapped lower and tested support below 1.3650. The shift to a speculative net long position in the dollar will curb the potential for further position adjustment in the dollar’s favour.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 76.65 area against the yen on Friday, but it was unable to advance above the 77 region as narrow ranges prevailed again. There was further defensive support for both currencies which lessened the scope for movements in the pair.

The dollar was again hampered by a lack of support, although there was speculation that there would be defensive capital inflows into US Treasuries.

There were no policy announcements surrounding measures to weaken the yen at the G7 policy meetings and trading activity was also stifled by a Japanese market holiday on Monday.

Sterling

Sterling was unable to make any strong headway against the dollar on Friday with resistance on moves towards the 1.5850 area, although there was support below 1.5750 as the UK currency made some progress against the Euro.

The latest Rightmove house price index recorded an increase of 1.5% for September after a 0.3% decline the previous month. Euro-zone trends tended to dominate and had a mixed Sterling impact. There was some potential for defensive capital flows in a flight from the Euro area. The potential benefits were partially offset by fears that there would be substantial UK economic damage if Euro-zone difficulties continue to intensify. This would be potentially extremely negative for Sterling given that the debt position is already precarious and underlying confidence in the UK economy remained very weak. Sterling dipped to test support below 1.57 on Monday as the dollar secured wider gains.

Swiss franc

The Euro held broadly steady against the franc on Friday, although it was unable to extend gains. The dollar found support below 0.87 against the franc and rallied to above 0.8750 with a further move to above 0.88 in Asia on Monday.

The National Bank will maintain its minimum 1.20 Euro level in the short term and there is likely to be a very strong defence of this level given the financial and political capital deployed to prevent fresh franc gains.

There was still speculation that any further deterioration in the Euro-zone situation could trigger an over-whelming flow of capital into Swiss institutions which would put the National Bank policies under extreme pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

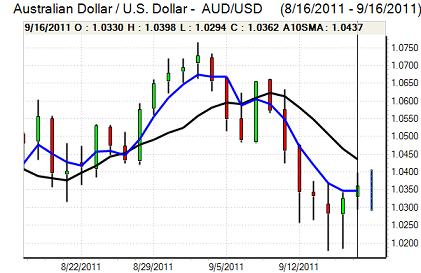

Australian dollar

The Australian dollar maintained a solid tone for most of Friday and pushed to a high near 1.04 during the New session before edging slightly lower. There was renewed selling pressure in Asian trading on Monday with lows below 1.0250.

There was a sharp deterioration in risk appetite as Euro-zone leaders made no progress on the Greek debt crisis while wider Euro-zone fears also increased. There were also fears surrounding the global growth outlook which undermined demand for the Australian dollar, especially as unease over the Chinese economy also increased. There was little confidence in the domestic economy as doubts surrounding the housing sector persisted.