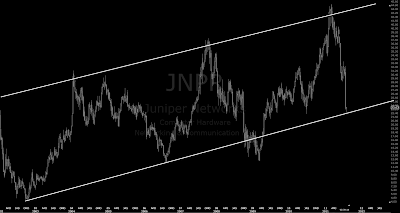

I bought also JNPR 13 months double bottom (weekly channel bottom). So far it started to respond well.

It seems last month has been beautifull for shortside and unfortunately many missed this because of holiday season. I am not only one.

I do see very attractive shortsetups developing for this autumn by EW point of view with some individual stocks, but also, there will be buyers to pick up very cheap stocks which this market hammers. Volalitet autumn ahead but SPX ~1280 is territory where I am planning to leave my longs. I think today was very classical bottom making in Europe during afternoon / US opening.

1232 is 38.2% retracement, so potential A wave. This all still leaves all possibles open for upside all the way to the 1400 area.

Be concervative, more close of 1300 with this oversold market is likely on the way. Market can test this same 1230 more than once but it won´t give that away easily.

SNDK, NVDA are some other technical names I like with daily charts.

However, I see huge risk later for autumn, with many equity (daily)charts EW can suggest to place AB waves for full impulse to open C down later. Once they retrace up those 61.8% – 86.2% territories scenarios can come very ugly.