EUR/USD

The Euro found support on dips to the 1.4325 area against the dollar during Monday and edged firmer later in the US session as underlying US confidence remained weak.

Talks over the US debt ceiling continued to dominate during the day as a deal remained elusive. Congressional leaders in the House of Representatives and Senate continued to push alternative plans for longer-term budget cuts in order to secure agreement for an increase in the debt ceiling. House Republicans are aiming for a two-stage deficit reduction plan with a projected US$1.2trn in savings over the next 10 years, but with the debt ceiling raised for only a few months. The Senate is pushing a plan for bigger cuts with the debt ceiling extended to beyond the 2012 elections.

President Obama warned over the default risk in a statement late on Monday which served to further unsettle market confidence in the US economy and dollar, especially as Obama has vowed to block any short-term debt-ceiling increase.

Markets were clearly worried over the outlook for a debt default and the potential damage on market confidence, especially as there would be an increase in funding costs. Markets were also concerned that, even if a default is avoided, there would only be a short-term decision to increase the debt ceiling which would increase the risk of a sovereign rating downgrade.

Given the focus on US debt, the Euro-zone structural issues were of secondary importance. There were still underlying fears surrounding the Greek situation and there was an increase in peripheral yield spreads. The Italian Treasury also announced that it would cancel forthcoming August debt auctions which increased unease over the debt situation.

Dollar vulnerabilities continued to dominate and the Euro rose very sharply to highs just above 1.4500 against the US currency following Obama’s comments.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, pleasego here

Yen

The dollar remained under pressure against the yen during European trading on Monday, but did find support close to the 78 level. There were reports of semi-official bids in the 78 area which helped cushion the US currency from further aggressive selling.

Underlying confidence in the US economy and currency remained weak as fears over a US debt default and credit-rating downgrade continued to increase. In this environment, there was defensive demand for the Japanese currency.

Finance Minister Noda continued to warn over the possibility of intervention while Trade Minister Kaieda openly called for Bank of Japan action as fears over export competitiveness increased. The dollar dipped below the 78 level in Asia on Tuesday and after briefly spiking higher to the 78.50 area the US currency weakened again.

Sterling

Sterling found support on dips to 1.6265 against the dollar on Monday with sharper falls averted by underlying US vulnerability as the Euro found support near the 0.88 level.

The latest UK mortgage lending data was slightly stronger than expected, but underlying lending remained weak which dampened confidence. Business Secretary Cable called for more quantitative easing and, although this was rejected by the Prime Minister, the government did stated that the economy was facing very challenging times.

Downbeat rhetoric from government officials increased speculation over a weak GDP release on Tuesday which undermined Sterling confidence. The UK currency was still able to gain some protection from fears over the Euro-zone outlook and a lack of confidence in the US. In this context, dollar weakness dominated in Asia on Tuesday with Sterling advancing to a five-week high above 1.6350.

Swiss franc

The Euro remained under pressure against the franc on Monday, retreating to lows below 1.1550 before rallying back to the 1.16 area. The dollar was also under heavy selling pressure and retreated to fresh record lows close to the 0.80 level as selling pressure was relentless.

There was a persistent lack of confidence in the Euro and dollar outlook which continued to trigger defensive demand for the Swiss currency. Although there was no evidence of intervention, markets remained on high alert over the situation and there will be a reluctance to maintain aggressive long franc positions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, pleasego here

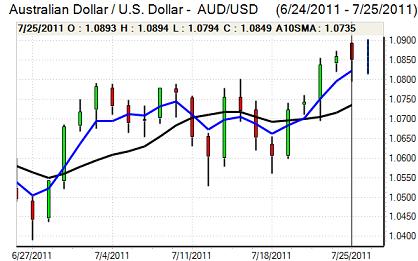

Australian dollar

The Australian dollar found support close to 1.08 against the US currency on Monday and surged higher from late in the US session as the US unit came under pressure. A break of resistance levels above 1.0850 helped propel the currency to a two-month high above 1.09 in local trading on Tuesday.

The Australian dollar was seen as a relative safe-haven as confidence in the US economy and currency deteriorated, especially with gold prices still at extremely high historic levels. There was still some concern over the Asian economic outlook which curbed buying support to some extent.