EUR/USD

The Euro found support below 1.41 against the dollar during Tuesday and pushed to highs above 1.42 on two occasions, but was unable to sustain the gains and dipped back to consolidate near 1.4150.

There was relief over a decline in Italian bond yields which helped lessen the immediate contagion risk within the Euro-zone, although confidence remained extremely fragile. There was also a further increase in Spanish yields to a nine-year high at the latest bond auction which maintained fears over underlying stresses.

Comments from ECB and European government officials remained under very close scrutiny during the day ahead of Thursday’s EU summit. There were suggestions that a new banking-sector levy could be imposed to help finance a second Greek bailout. German Chancellor Merkel was anxious to downplay expectations and stated that markets should not expect a single and final solution to the Greek crisis at the summit.

ECB member Nowotny appeared to suggest that the bank could accept Greek securities as collateral even if there was a temporary default, which appeared to contradict President Trichet’s long-standing opposition to such a policy and uncertainty remained extremely high. The German ZEW business confidence index weakened to -15.1 for July from -9.1 previously with later responses notably more pessimistic than earlier replies according to the ZEW institute.

The US economic data was stronger than expected as housing starts rose to an annual rate of 630,000 for June from a revised 550,000 previously while permits also rose strongly. There were some hopes that the Administration and Congress were moving closer to an agreement with President Obama endorsing deficit-cutting measures. The dollar failed to gain much benefit as there was also an improvement in international risk appetite.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There were spikes in dollar/yen during Tuesday as markets looked to trigger breaks, but ranges overall were still relatively narrow. The dollar found support below 78.90 following the stronger than expected US data and also secured gains later in the US session as a boost to yield support was amplified by improved risk appetite on hopes for a US budget deal.

There was a slight easing of fear surrounding the Euro-zone which curbed immediate yen demand, but uncertainty will remain extremely high which will lessen underlying yen selling pressure.

The dollar pushed to a high near 79.30 before settling slightly lower with caution over the Asian growth outlook as well as Euro-zone doubts creating further caution over aggressive yen selling.

Sterling

Sterling found support close to 1.61 against the dollar during Tuesday , but was unable to sustain a move above 1.6150 in choppy trading conditions while the Euro was blocked close to 0.88.

There were no major UK releases during the day with the political fall-out surrounding the phone-hacking scandal receiving some market attention. There will be speculation that any loss of government authority will make it even more difficult to manage any fresh deterioration in the economy which could also undermine international sentiment.

The Bank of England minutes will be watched closely on Wednesday and Sterling will be vulnerable if there were hints over any near-term move to expand quantitative easing. This looks unlikely at this stage, but a general sense of pessimism would tend to undermine the currency. Sterling edged marginally weaker in Asia on Wednesday.

Swiss franc

The dollar found support on dips towards 0.8150 against the franc during Tuesday and rallied strongly late in the US session with highs above 0.8260. There was high volatility on the Euro/Swiss cross with the Euro eventually strengthening to near 1.1680 after a sharp setback during New York trading.

The Euro-zone developments remained a very important focus during the day as underlying tensions continued to increase. A decline in Italian yields and some respite in general risk aversion helped weaken the Swiss currency, especially as there was further speculation that the National Bank could intervene. There will still be a high degree of uncertainty and tensions return very quickly with high volatility likely to be the key feature.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

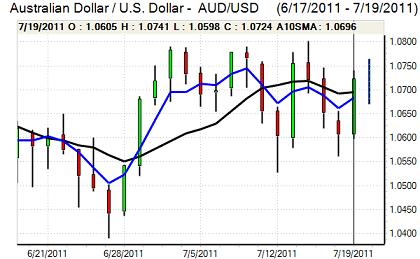

Australian dollar

The Australian dollar found support close to 1.06 against the US dollar during Tuesday and rallied steadily to a high near 1.0750 in Asia on Wednesday before drifting weaker. There was a general improvement in risk appetite during the day which helped underpin the Australian currency as equity markets looked to rebound.

The currency was still gaining some support on yield grounds even though the Reserve Bank minutes suggested that a near-term increase in rates was less likely. Domestically, a slightly weaker than expected reading for the leading index did not have a significant market impact.