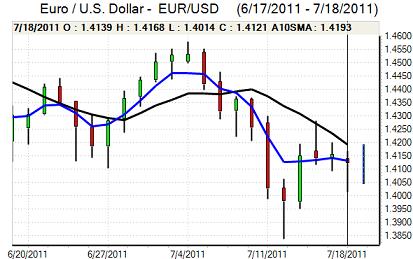

EUR/USD

The Euro remained firmly on the defensive in European trading on Monday as Euro-zone debt fears continued to increase. There was a sharp move higher in peripheral yields during the day with Spanish yields above 6.3% while Italian yields again pushed above 6.0% with yield spreads over German bunds at their highest since the Euro’s inception in 1999. The bank stress tests announced on Friday failed to bolster confidence and markets continued to fret over wide policy divisions.

The German government continued to insist that private bondholders must accept losses as part of any new support package while the ECB continued to insist that there could be no Greek default. Tensions will remain high ahead of Thursday’s EU summit, especially with market pressures continuing to build. Any attempt to delay decision making could result in a further substantial increase in pressure on the European banking sector.

The latest US capital account data recorded a decline in net long-term inflows to US$23.6bn for May from US$30.6bn the previous month which suggested that foreign appetite for US investments had fallen, although there was an increase in long-term US Treasuries held by China.

There was no substantive progress in budget talks between the Administration and congressional leaders. Although markets were remain reluctant to believe that there could be a default, uncertainty will inevitably remain a key feature over the next few days.

The Euro found support close to the 1.40 area with speculation over sovereign buying at lower levels and it rallied to a high near 1.4140 before drifting lower again.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained trapped within narrow ranges against the yen over the past 24 hours with intermittent spikes in the currency not having any sustained impact. There was support just below 79 while there was no move above the 79.20 region.

Risk conditions remained generally fragile on Euro-zone debt fears which curbed potential capital outflows from Japan and also served to protect the Japanese currency. There was also fresh speculation over potential capital repatriation of Euro-zone bonds which underpinned the yen.

Finance Minister Noda and deputy Bank of Japan Governor Yamaguchi both warned over the impact of a strong yen and pledged that decisive action would be taken if necessary.

Sterling

Sterling was unable to move much above 1.61 against the dollar during Monday and retreated sharply during the US session with a low near 1.60 as stop-loss selling triggered heavy selling. Cross-related moves remained important with the Euro finding strong support near 0.87 before rallying back to above 0.8775.

There were further doubts surrounding the UK growth outlook which undermined Sterling sentiment. There were also concerns over the UK banking sector with share prices falling sharply amid fears that Euro-zone stresses could trigger further loan provisions undermine the capital base and restrict lending.

The Bank of England minutes will be watched closely on Wednesday and the bank is likely to be cautious over the outlook, although there is unlikely to be hints of any near-term move to sanction additional quantitative easing. Sterling did find support near 1.60 before rallying back to the 1.6075 area.

Swiss franc

The Euro found support blow 1.14 against the franc during Monday and, although Euro-zone confidence remained extremely fragile, it was able to regain some ground with a move back above 1.15. The Euro’s ability to rally despite an increase in fear surrounding the debt situation raised speculation that there could have been National Bank intervention, but the market moves were not large enough to suggest any decisive bank action. The dollar rallied to a high near the 0.82 level.

The Swiss franc will continue to be the dominant global safe-haven currency and Euro-zone developments will continue to be watched very closely given market sensitivity to the issues.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

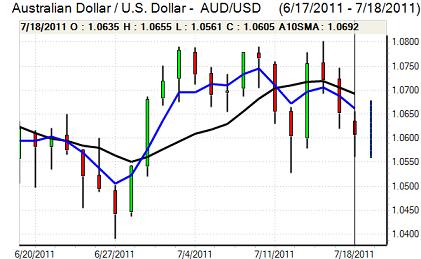

Australian dollar

The Australian dollar found support on dips towards the 1.0560 area against the US dollar on Monday and rallied back to a high near 1.0650 as risk conditions attempted to stabilise.

The Reserve Bank minutes were more cautious over the outlook for the economy and the bank also switched to a more neutral tone with a decision to adopt a more wait and see attitude on interest rates. The minutes did have an impact in dampening interest-rate expectations and pushed the currency weaker, although the impact was measured.

The Australian currency was also unsettled by a general deterioration in risk appetite, although there was still solid buying interest on dips which continued to cushion the currency.