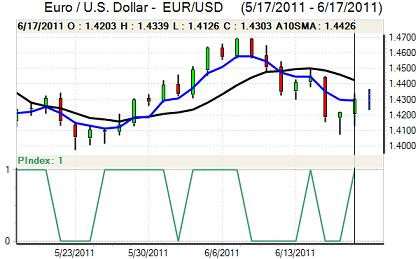

EUR/USD

The Euro found support on dips to the 1.4130 area against the dollar during Friday and then advanced strongly during the European session as Greece continued to dominate the headlines.

In a joint press conference, German Chancellor Merkel and French President Sarkozy stated their backing for a new Greek support package and, crucially, Merkel suggested that any debt restructuring must be done on a voluntary basis which effectively dropped previous insistence that there must be some private bond-holder losses. The German shift eased immediate fears that Greece would be pushed to default which also boosted the Euro which rallied to a high above 1.43.

In meetings on Sunday, Euro-zone officials stated that they would continue to work on a new support package, but no decisions were made. There was also no final decision on the next Greek loan payment due in early July and there were also further warnings that any support was dependent on additional Greek austerity measures.

Market confidence inevitably remained fragile given severe doubts whether Greece would be able to deliver on budget measures. There was also strong political opposition from within Germany while Moody’s put the Italian credit rating on negative watch.

Euro-area money-market developments remained under close scrutiny amid fears that banks were withdrawing capital from the region and curbing inter-bank credit lines. If this trend is sustained , then there would be even greater fears over the Euro-zone banking sector.

The latest US University of Michigan consumer confidence data was slightly weaker than expected with a decline to 71.8 for June from 74.3 previously which will maintain unease over US growth trends and there were further expectations that the Fed would downgrade its growth forecasts this week. The dollar will tend to remain vulnerable on yield grounds, but the Euro dominated on Monday and it retreated back to the 1.4220 region.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any challenge on resistance above 80.70 against the yen in European trading on Friday and the currency came under fresh selling pressure with a decline to 80.00 during the Asian session on Monday. There was no improvement in US yield support which curbed dollar support, especially with markets expecting a generally dovish tone from the Federal Reserve later this week.

Domestically, there was a second successive monthly trade deficit for Japan as exports continued to be damaged by the March earthquake. There was, however, some optimism that economic conditions were starting to improve.

Risk conditions remained very important and there was certainly a mood of greater caution which provided yen support. Markets will remain sensitive to the threat of intervention if the yen strengthens through the 80 zone with reports of solid buying interest near this pivotal figure.

Sterling

Sterling found support just below the 1.61 level against the dollar during Friday and rallied as the Euro recovered, but the UK did lag significantly and was unable to regain the 1.62 level as the Euro moved towards 0.8850.

The latest Rightmove index of UK housing sector asking prices recorded a 0.6% increase for June to the highest level since August 2007, but overall expectations were that housing activity would remain weak with buyers unwilling to increase offers. Overall confidence in the economy also remains at a low ebb as surveys continue to suggest that consumer spending is weakening.

The UK banking sector will be an important focus in the short term. There will be fears over the implications of any debt default within the Euro-zone, especially as this would increase debt write-downs in the UK. The currency impact will inevitable be mixed as there would also be substantial damage to the Euro area. Volatility is liable to remain higher in the short term with Sterling retreating to lows below 1.6120 on Monday.

Swiss franc

The dollar was unable to break above the 0.8510 area against the franc on Friday and retreated to lows just below 0.8450 before a fresh push higher. Dollar moves were cushioned by trends on the crosses as the Euro rallied to the 1.2150 area before stalling.

Euro-zone debt developments will continue to be watched very closely in the short term and the franc will secure fresh defensive support if there is any renewed speculation over a near-term Greek default. Concerns over the European banking sector have increased over the past few days which will maintain underlying demand for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

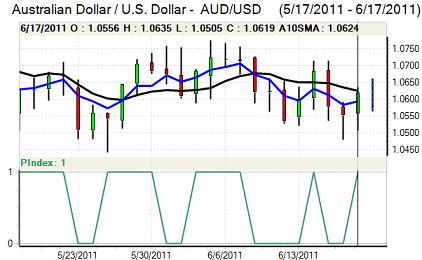

Australian dollar

The Australian dollar found support close to 1.05 against the US dollar during Friday and rallied to a high just above 1.0620 against the US currency as the Euro rallied and risk appetite improved following Merkel’s press conference.

There was also some relief that Chinese interest rates were not increased again over the weekend, butt he Australian dollar was unable to extend the rally and retreated back to the 1.0560 area as the Euro retreated from its best levels. There was also underlying caution over the global economy on fears over weaker growth while domestic economy is also generally weaker.