EUR/USD

The Euro was unable to break above the 1.4350 area against the dollar during Friday and was subjected to renewed selling pressure during the New York session as volatility also increased sharply. There were further stresses surrounding the Euro-zone sovereign-debt crisis which undermined confidence in the currency. There was a further ratings downgrade of Greece by Fitch and reports that Norway had suspended a scheduled loan payment as conditions had not been met.

The IMF and EU inspectors also called off their inspection of Greece stating that further progress on agreed reforms was necessary before it could resume and fears of a policy vacuum tended to increase. Subsequently, Italy’s credit rating was put on negative watch by Standard & Poor’s which increased the potential contagion threat.

The dollar gained support from a wider deterioration in risk appetite and the Euro dipped to lows near 1.4150 later in the US session.

There was a heavy defeat for Spain’s socialist party in regional elections which maintained downward pressure on the Euro. The latest IMM positioning reported a sharp decline in net Euro longs, but there was still a substantial position which will lessen the potential for a Euro rebound. The net speculative short US dollar position declined to around US$20bn from US$27bn the previous week.

In contrast, there has been further speculation over Asian central bank buying as part of reserve diversification which will underpin the currency with the Euro finding some support below 1.4080 in Asia on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 81.50 area against the yen on Friday and generally consolidated in a 81.50 – 81.80 range as the Japanese currency gained some respite on the crosses with the Euro retreating sharply from 3-week highs.

The yen gained protection from a general shift towards risk aversion with continued volatility in commodity prices lessening demand for carry trades funded through the Japanese currency.

Asian equity prices remained on the defensive on Monday, but the dollar did advance towards the 82 level with the yen still suffering from a lack of confidence in the underlying fundamentals even though attention remained firmly on the Euro area.

Sterling

Sterling dipped to lows below 1.6180 against the dollar on Friday, but found firm support and briefly pushed to a high near 1.63 in New York before settling back to the 1.62 area as the US currency gained wider strength. Trends in Euro/Sterling had an important impact with Euro losses to below the 0.87 level providing important support for Sterling.

Trends within the Euro-zone remained under close scrutiny, especially as they will have an important impact on the UK economy and currency. In theory, Sterling could gain support from a lack of confidence in the Euro with diversification into the UK currency. There have, however, also been increased fears over the UK banking sector which will tend to undermine Sterling. Volatility is liable to remain a key feature.

The UK economic data will be watched closely this week with the latest government borrowing data due on Tuesday and the GDP revision on Wednesday. Any upward revision to growth would have some positive initial impact on the currency.

Swiss franc

The dollar pushed to a high near 0.8850 against the franc on Friday ahead of the US open, but was then subjected to a sharp reversal as the Swiss currency advanced to a high in the 0.8750 region. There were equally rapid moves on the Swiss crosses with the Euro pushed sharply lower to record lows beyond 1.2350 before a partial reversal.

There were reports that a deal on Hungarian franc-denominated mortgages sparked the move, but there were also suspicions of substantial capital flows into the Swiss currency as Euro-zone turbulence persisted. The franc also gained some defensive support from a general deterioration in risk appetite.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

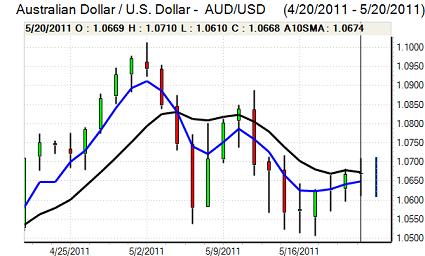

The Australian dollar pushed to a high near 1.07 against the US currency during Friday before retreating sharply to the 1.0620 area as there was a wider deterioration in risk appetite and widespread US currency gains.

This trend continued in Asian trading on Monday as the Australian currency tested support below the 1.06 level. Domestic trends were of secondary importance, although there was some concern over the banking sector. There is still a substantial net long speculative position in the Australian dollar which will maintain the potential for a further downward correction, especially if international risk appetite remains more fragile.