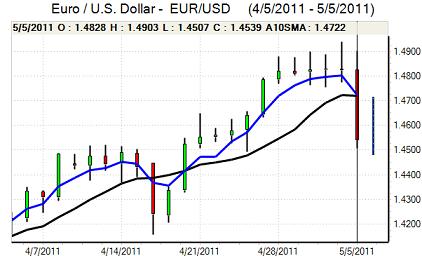

EUR/USD

The Euro made a brief push towards 1.49 against the dollar ahead of the ECB interest rate decision on Thursday before drifting back to the 1.4825 area.

There was no surprises with the ECB decision with interest rates on hold at 1.25%. In the press conference following the decision, President Trichet stated that policy was still very accommodative and that the inflation risks were still to the upside. These comments suggested that the central bank was still expecting to tighten policy further over the next few months.

Trichet also stated that developments would be monitored very closely. In the coded messages delivered by the central bank, this suggested that interest rates would not be increased at the June meeting with the bank giving itself more time to assess the situation, especially with very important structural vulnerabilities. The comments and a decision to maintain extraordinary liquidity measures triggered a reassessment of interest rate expectations and also triggered downward pressure on the Euro.

The latest US economic data was again sharply weaker than expected with an increase in jobless claims to an eight-month high of 474,000 in the latest week from a revised 431,000 previously. The data triggered a deterioration in risk appetite and there was also a very sharp correction in commodity prices as oil prices fell by over US$12 per barrel to below US$100 and there was a very sharp reduction in short dollar positions.

The combination of short dollar covering and a corrective retreat in the Euro pushed the Euro sharply lower with the biggest decline for eight months as it weakened to lows near 1.45. The currency was still hampered by expectations of a dovish Fed stance and there was caution ahead of Friday’s payroll release.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen maintained a strong tone on the crosses during Thursday as risk appetite deteriorated and there was a sharp decline in commodity prices. The dollar also came under heavy selling pressure and weakened to lows near 79.50, the weakest point since March’s G7 intervention.

There was market speculation over renewed intervention to weaken the yen. The Japanese Finance Ministry stated that it was watching market conditions very closely, but also that the situation was different from that in March

There was some stabilisation in conditions later in the US session which curbed buying pressure on the yen and there was increased dollar buying during the Asian session as Tokyo markets re-opened following a three-day holiday. The latest data recorded a 23.9% expansion of the monetary base in the year to April which will maintain longer-term fears over the yen outlook.

Sterling

Sterling consolidated just above 1.65 against the dollar in early Europe on Thursday and then weakened sharply to re-test support near 1.6450 following another weaker than expected PMI report. The services-sector index fell to 54.3 for April from 57.1 previously, maintaining the run of poor survey evidence this week.

As expected, the Bank of England left interest rates on hold at the latest MPC meeting. There was no statement following the decision and the vote split will not be released for two weeks. Following the weaker than expected data, there was a further scaling back of interest rate expectations which undermined yield support with further concerns that interest rates are negative in real terms.

International trends tended to dominate in the New York session with the sharp Euro decline helping Sterling to recover from lows beyond 0.90 as ECB rate expectations were also downgraded. Sterling weakened to temporary lows near 1.6350 against the dollar as a function of wider US gains.

Swiss franc

The dollar remained under pressure against the franc on Thursday, but gained significant relief following the ECB press conference and rallied to a high above 0.87 from lows below 0.86. The Swiss currency maintained a strong tone against the Euro as it strengthened to a peak beyond 1.2650.

A deterioration in risk appetite boosted demand for the Swiss currency and yield spreads against the Euro also narrowed following the ECB press conference. The Swiss unemployment rate was unchanged at 3.3% and domestic economic considerations will remain of secondary importance in the short term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

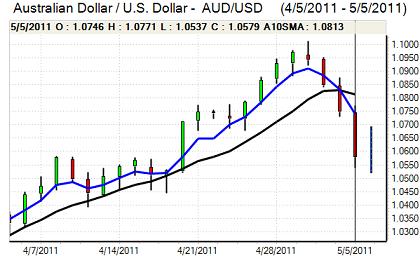

Australian dollar

The Australian dollar initially found support just below 1.07 against the US dollar on Thursday, but selling pressure intensified during the US session as risk appetite deteriorated and there were very sharp declines in commodity prices. The Australian currency weakened rapidly to lows below 1.0550 before stabilising.

In its monetary policy statement, the Reserve Bank was more hawkish than expected with warnings that interest rates were likely to rise further and this helped the Australian dollar rally back to the 1.07 area as volatility remained very high with a weak construction PMI report not having a major impact.