Apple Inc. (AAPL) is the first chart I look at almost every morning of my career and if you watch the Morning Call you see I cover it in some form almost every show. The reason I like to look at and trade Apple is that it trades very well technically, providing active traders with good, calculated and measured moves.

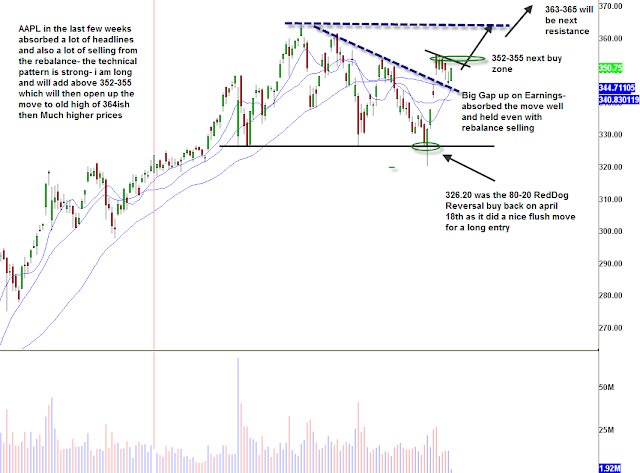

Back on April 16th my RedDog reversal strategy triggered for a buy into support around $326.80. Then company came out and reported very impressive earnings this quarter and stock responded well and gapped up into resistance. AAPL reported record EPS of $6.40,. a 95% surge in quarterly profits, and topped revenue estimates by more than 1 billion dollars, largely in part to strong iPhone sales. The iPad 2 arrived in Japan last week and is coming to 11 new countries today, with the tablet looking to be the next big money maker for Apple.

Since then it’s held the earnings gap and absorbed a lot of bad news. Uncertainty over Steve Jobs’ future with the company is the darkest cloud, while supply chain concerns in Japan have also surfaced. More recently index rebalancing has triggered weakness in the stock, as its Nasdaq weighting went from 20% to 12%. This rebalancing will end at the close today.

I think you can tier one AAPL in this $345-350 area, and then add for a momentum tier once it clears $352-355 at some point in the next few sessions. This will take us to the old resistance around $364 then new highs to my ultimate target this year around $420-450.

*DISCLOSURE: Long AAPL

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.