EUR/USD

After surging higher following the Federal Reserve FOMC meeting amid a wave of dollar selling, there was a general tone of consolidation during European trading on Thursday and the Euro retreated initially back to the 1.4825 area.

The headline US GDP release was slightly weaker than expected with an annualised increase of 1.8% compared with 3.1% in the fourth quarter as the economy was held back by a dip in government spending. Elsewhere, the latest jobless claims data was weaker than expected with an increase in initial claims to 429,000 in the latest week from a revised 403,000 previously, but there was a stronger than expected 5.1% increase in pending home sales.

The data will not have a significant impact on interest rate expectations with markets still assuming that the Federal Reserve will maintain an ultra-loose monetary policy with the US currency still vulnerable on yield grounds.

The US and G7 stance on the dollar will continue to be watched closely in the short term. US Treasury Secretary Geithner made supportive comments surrounding the dollar for the second time of this week which suggests that the dollar is being taken more seriously. There will also be growing unease over the situation within the Euro-zone. There is a grater chance that European officials will look to talk down the Euro and there is also a greater chance of a concerted G7 effort to stabilise currencies.

The dollar strengthened to 1.4770 against the Euro, but there was still strong Euro buying support on dips as it pushed back to the 1.4830 area in Asia on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to regain the 82 level against the yen during Thursday and retreated to lows just below 81.50 before finding support. The US currency failed to gain any additional support on yield grounds following the GDP data which limited buying support.

There were further reports of institutional dollar buying in the 81.50 area which cushioned the US currency from further selling pressure. Japanese markets were closed for a holiday on Friday which curbed market activity and there will be a succession of holidays in the first week of May which will also curb trading activity.

There has been further evidence of increased capital flows from Japan as investment funds look for higher returns and this should tend to weaken the Japanese currency, especially if there is a greater willingness to leave positions un-hedged.

Sterling

Sterling hit tough resistance on the approach to 1.6750 against the dollar during Thursday and it retreated to lows near 1.6620 in Asia on Friday. Movement on the Sterling crosses had a significant impact as there was strong reported Euro/Sterling buying during the European session as the Euro challenged levels above 0.89. Month-end demand could trigger further volatility during Friday even though UK markets will be closed for a holiday.

Bank of England MPC member Sentence continued to advocate higher interest rates, but market expectations are still that the central bank will hold rates steady in the short term as fears over the growth outlook take precedence, especially with energy prices still at extremely high levels.

The UK currency will continue to gain protection from a lack of confidence in the dollar and from Euro-zone structural fears.

Swiss franc

The dollar found support close to the 0.87 level during Thursday, but was unable to make much impression and was capped in the 0.8750 area. The Euro edged stronger against the Swiss currency with consolidation around the 1.2950 area.

Any attempt by G7 members to curb further dollar losses would tend to dampen safe-haven demand for the franc, but the currency should be able to resist heavy selling pressure, especially if there is another robust reading for the KOF business confidence index which would ease fears over the impact of a strong franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

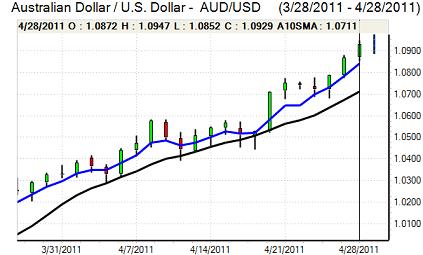

Australian dollar

The Australian dollar hit selling pressure close to 1.0950 against the US currency during Thursday and retreated to lows near 1.0860 before fresh buying support appeared. It was difficult to regain momentum as pressure for a more substantial correction increased.

The domestic influences remained limited at this stage with a slightly stronger than expected reading for consumer credit.

There have been further expectations of merger-related capital inflows and optimism surrounding commodity prices remains intact.