Add Aetna Inc. (NYSE:AET) to the list of rival health care insurers UnitedHealth Group Inc (NYSE:UNH), WellPoint Inc (NYSE:WLP) and Humana Inc (NYSE:HUM) that are seeing windfall profits this earnings season ahead of federal health care reform.

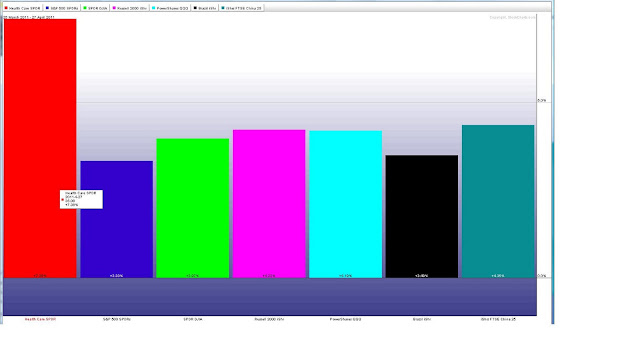

Over the last month the health care group, using the Health Care Select Sector SPDR ETF (NYSE:XLV), has outperformed the SPDR S&P 500 (NYSE:SPY), the PowerShares QQQ Trust (NASDAQ:QQQ) and the iShares Russell 2000 Index (NYSE:IWM). See performance chart below.

The Health Care Select Sector SPDR ETF (NYSE:XLV) is comprised mostly of large health care plan stocks like Aetna Inc. (NYSE:AET) and major drug stocks. However, it is the smaller cap health care plan stocks like AMERIGROUP Corp. (NYSE:AGP) posting the out-sized gains.

Fee increases are basically making it cost prohibitive for policyholders to seek preventative care in this slow recovering economy. dealing with high unemployment and rising commodity prices. For individuals and families dealing with high unemployment and rising commodity prices as they count every dollar, health insurance plans have now become “break in case of emergency” policies, similar to car and home insurance.

This trend allowed health care insurers as a group to raise their full-year profit forecasts, start dividends or significantly raise payouts in the past week. Health insurers’ stocks are trading at multi-year highs.

Below we list the top US health care plan stocks by year-to-date performance, as they have the potential to outperform their peers and the overall market, assuming the health care group continues its recent relative strength against major US indices.

AMERIGROUP Corp. | NYSE:AGP | YTD Perf.: +55.97%

Sector: Healthcare | Industry: Health Care Plans | Market Cap.: 3.32B

HealthSpring Inc. | NYSE:HS | YTD Perf.: +55.37%

Sector: Healthcare | Industry: Health Care Plans | Market Cap.: 2.30B

Molina Healthcare Inc. | NYSE:MOH | YTD Perf.: +53.93%

Sector: Healthcare | Industry: Health Care Plans | Market Cap.: 1.27B

WellCare Health Plans, Inc. | NYSE:WCG | YTD Perf.: +44.61%

Sector: Healthcare | Industry: Health Care Plans | Market Cap.: 1.82B

Humana Inc. | NYSE:HUM | YTD Perf.: +41.30%

Sector: Healthcare | Industry: Health Care Plans | Market Cap.: 12.78B

Centene Corp. | NYSE:CNC | YTD Perf.: +41.28%

Sector: Healthcare | Industry: Health Care Plans | Market Cap.: 1.77B

Aetna Inc. | NYSE:AET | YTD Perf.: +36.39%

Sector: Healthcare | Industry: Health Care Plans | Market Cap.: 15.16B

Unitedhealth Group, Inc. | NYSE:UNH | YTD Perf.: +36.35%

Sector: Healthcare | Industry: Health Care Plans | Market Cap.: 51.93B

WellPoint Inc. NYSE:WLP | YTD Perf.: +35.13%

Sector: Healthcare | Industry: Health Care Plans | Market Cap.: 28.00B

*DISCLOSURE: None

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.