The multi-day sell-off in early March, resulting from the massive earthquake and nuclear fallout in Japan, gave investors a chance to really breakdown the markets from a relative strength standpoint. Finding stocks or markets that outperform after a general market pullback can provide potential clues to strength moving forward.

Early in March, T3 Watchlist highlighted the emerging markets showing relative strength against the SP500 (NYSE:SPY). Over the weekend Barron’s wrote a positive article on the emerging markets. This morning, the IMF released it’s latest global checkup, saying the world economic recovery is set to continue over the next two years.

So let’s take a look at the emerging market ETFs versus the SPYs since March 16th the pivot low to see if their relative strength is still intact.Â

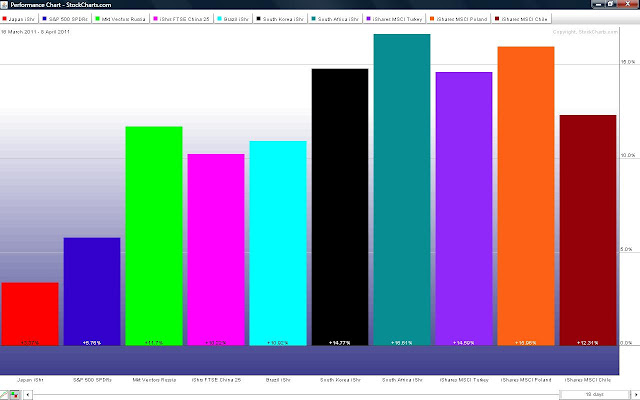

Most expected Japanese stocks to struggle in the midst of the disaster, yet the Japanese ETF (NYSE:EWJ) has performed admirably, up over 3% since the March 16th pivot low. Investors also cheered the quick rebound in the US markets, with SPY up over 5% since its pivot low – yet it barely outperformed Japan ETF with all its disaster issues.

However, it’s the performance of the emerging markets investors should be following. The widely known BRICs are all up over 10% since the Mar. 16th pivot, but many of the secondary and tertiary emerging markets are outperforming the BRICs. South Africa (NYSE:EZA), Poland (NYSE:EPOL) and Turkey (NYSE:TUR) have gained over 14% while tripling the performance of the S&P.

|

| Widely traded emerging market ETF performance since March 16th… numbers from the April 8th close. |

South Africa | NYSE:EZA | +16.61

Poland | NYSE: EPOL | +15.96

South Korea | NYSE:EWY |Â +14.77

Turkey | NYSE:TUR | +14.59

Chile | NYSE:ECH | +12.31

Brazil | NYSE:EWZ | +10.92

China | NYSE:FXI | +10.22

Russia | NYSE:RSX | +11.7

S&P 500 | NYSE:SPY | +5.76

Japan | NYSE:EWJ | +3.37

*DISCLOSURE: None

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.