While we have seen great sector rotation during this bounce over the past few weeks, one group we have not seen participate is the banks. The group has continued to cope with the uncertainty of new financial regulations, and each time they seem poised to break out they are reeled back in. However, it pays to watch some things that have yet to go, as laggards are often the last piece of the puzzle for a market to break out to highs, as we are close to doing.

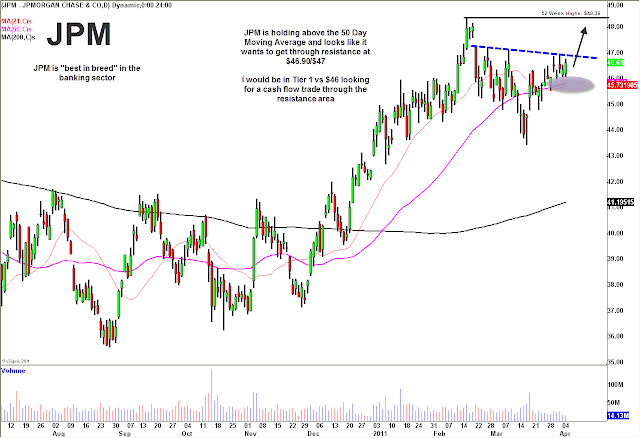

When you are trading a sector that is lagging as badly as the banks, it’s wise to only consider the strongest among them, which at this stage is clearly JP Morgan Chase & Co. (JPM). The stock is above all of its moving averages and looks like it will try to break above resistance. I am currently long “tier 2”, and will look to add if it can get above $46.86-46.90. This should be the first new bank to make new highs for the year, while others like former leader Goldman Sachs Group Inc. (GS) may play catch up as well. The stop on this trade would be $46.

*DISCLOSURE: Long JPM

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.