By: Zev Spiro

A potential bearish scenario for the major market indices was highlighted last Wednesday. There may be a range-bound consolidation, or bounce and roll-over, lasting anywhere from one to three weeks before going lower. Potential key resistance levels were outlined including the 50-Day Simple Moving Averages, minor down trend lines and a previous unfilled gap. Below is a trade idea in the Oil Services HOLDRs Trust (OIH), which has been in distribution mode for the past six weeks.

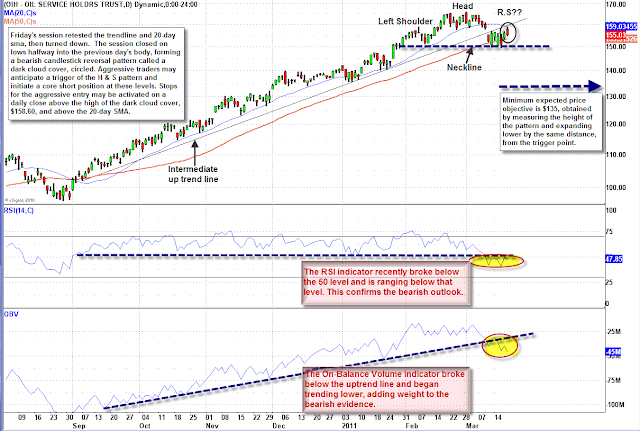

On March 10th the intermediate uptrend in OIH ended, signaled by a break below the 20-day simple moving average and intermediate up trend line.

On Friday the moving average and trend line were tested from below and provided resistance. A potential bearish head and shoulders pattern may be forming which will trigger with a confirmed break of the neckline. Aggressive traders may anticipate the trigger of the head and shoulders pattern and enter a core position early. Trigger: confirmed break of the neckline at approximately $149.35 to $150. Target: minimum expected price objective is $135, Protective Stop: confirmed move back above the neckline.

Updates:

1) Jabil Circuit, Inc. (JBL): Market Letter 3/15/11 – triggered last week with confirmation.

2) Cree, Inc. (CREE): Market Letter 3/15/11 – bounced into resistance on Friday, offering shorts a low risk entry opportunity.

3) Monsanto Co. (MON): Market Letter 3/2/11 – Close to the neckline (resistance), offering a compelling entry or add opportunity for shorts.

4) The Goldman Sachs Group, Inc. (GS): Market Letter 2/23/11 – The bounce may be offering shorts a low risk entry opportunity versus the 20-day simple moving average and/or the downtrend line that began from the highs of 2/16/11.

If you are interested in receiving Zev Spiro’s market letter, please email zevspiro@oripsllc.com subject “T3â€

*DISCLOSURE: Short OIH, JBL, CREE, MON, GS.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.