Why are we bearish?

Why are we bearish?

For one thing, we like to go bearish when the market is testing the top of it’s channel as there is generally a higher percentage probability that we drop than we pop back over. Secondly, as I mentioned yesterday, it’s not just the Federal Reserve that is in denial but the commodity speculators, the equity investors and even the bond investors as the ALL believe they are going to get paid while MATH says that’s not even remotely possible.

What is math? I know – thanks to cutbacks in our education budgets over the past 30 years, that is a question that vexes many Americans and it also creates a perfect environment for the people who CAN do math, those in the Financial sector perhaps, to design endless levels of complex instruments that are all designed to con people who have lower math skills than they do.

Complexity is good. Just like the legal scam, complexity forces you to seek assistance with your finances – the more money you have, the more complex your finances become and the more you need help and this allows swarms of leeches or, to be kind, remoras to attach themselves to you and feed endlessly off your earnings and savings (they don’t care which as they will happily destroy the host and simply move on to the next big fish).

Personally, I prefer simplicity. My Grandpa Max was a Depression kid who built a business from scratch and invested his money well and had a nice life for himself. He taught me how to invest when I was a little kid and, as you can imagine, he did not ask a “financial adviser” what to do with his money as he had seen where that had gotten his parents generation when he was young (he was 24 when the Global markets collapsed).

Our investing days would begin by reading the papers (not just one – they all say different things, don’t they) together and pointing out things that looked interesting. Not just the Business Section but whatever seemed like an important World event or a trend worth watching that would help us get ahead of the curve with our stock selections. This is pretty much what I do now isn’t it (thanks Grandpa!)? So, I will share with you what I consider the most important and simplest thing I see going on in the world today – something I have been pointing out for quite some time and the number one reason we remain very cautious on the markets – Inflation:

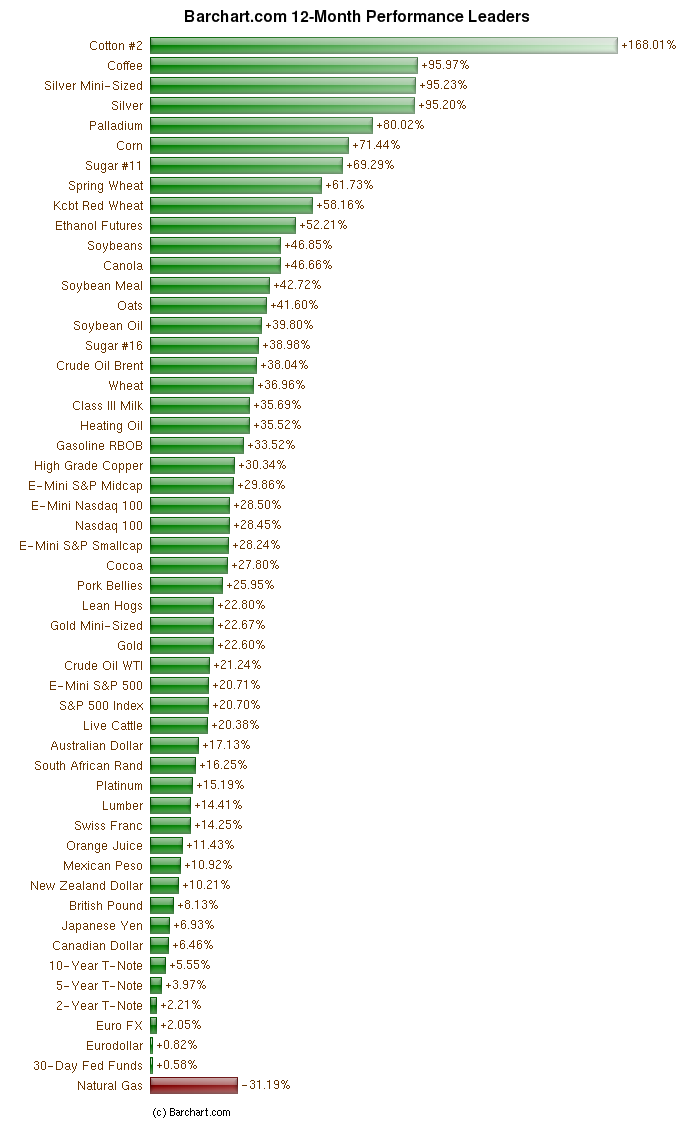

This is not complicated folks. This isn’t the hypothetical elephant in the room and it’s not the 800-pound gorilla we avoid talking about. This is a FACT! These are 12-month price hikes and this is also a 12-month decline in the dollar of 6.5-17.13% against other currencies and that is NOTHING compared to how far our buying power has fallen when measured in things we consume every day like cows (20.36%), oil (21.24%), hogs (22.8%), cocoa (27.8%), gasoline (33.52%), milk (35.69%), wheat (36.96%), sugar (38.98%), oats (41.6%), corn (71.44%), coffee (95.97%) and cotton (168.01%). THAT IS INFLATION FOLKS – no matter what lies your Government chooses to tell you.

As David Fry points out in his chart – That’s OK because we are a nation of fat, spoiled bastards anyway and we can all afford to cut back a little. That’s why a lot of inflation has been passed through to you in the form of smaller package portions at the store and smaller portions of lower-quality food at restaurants and maybe at your kitchen table. When you see 12-month price trends like this – it is kind of hard to imagine it’s all a temporary spike and will all be “back to normal” by summer, right?

IN PROGRESS