EUR/USD

The Euro found solid support in the 1.3750 area against the dollar during Wednesday and again pushed higher during the New York session with a challenge on resistance in the 1.3860 area. A break above this level triggered a peak near 1.3880 before a limited correction weaker as speculative dollar selling persisted.

The dollar generally remained on the defensive and was near 4-month lows with the currency unable to derive safe-haven support. There were also underlying fears over the US budget position, especially with further concerns over the threat of municipal debt defaults.

The US economic data was stronger than expected with an ADP employment increase of 217,000 for February following a revised 189,000 gain the previous month which maintained expectations for a firm payroll reading on Friday.

The Federal Reserve Beige Book reported that the economy was still growing moderately while there was evidence of manufacturers passing on higher costs. Fed Chairman Bernanke maintained his determination to support the US economy and conceded that further quantitative easing was a possibility if required to stop the economy faltering.

The ECB will be an extremely important focus on Thursday as the council holds its monthly meeting. Following tougher rhetoric by officials during the past two weeks, there are strong expectations that the ECB will signal a more aggressive policy stance with the possibility that an interest-rate increase will be signalled for the second quarter. The central bank still has to very careful in its judgements which may result in the hawkish tone being moderated slightly.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar attempted to rally following US data releases on Wednesday, but it was unable to break above 82.20 and drifted weaker again later in the session. The US currency is finding it difficult to gain support from higher yields which is a potentially worrying sign for the US currency even though support should be solid.

The yen will continue to gain support on a lack of risk appetite as Middle East tensions persist, especially as there will be greater caution over carry trades.

Capital repatriation flows will be watched closely as there is scope for significant flows over the next three weeks before the Japanese fiscal year-end. The dollar dipped to lows near 81.60 before consolidating in the middle of its recent range.

Sterling

Sterling found support close to 1.6220 against the dollar during the early European session on Wednesday and then pushed higher again to challenge 13-month highs above 1.63.

The UK data again provided support with an increase in the PMI construction index to 56.5 for February from 53.7 the previous month. The services-sector data will be very important for Sterling sentiment on Thursday, especially given the sectors dominance within the economy. A robust reading would make it much easier for the Bank of England to contemplate an early increase in interest rates while any significant decline would strengthen the argument for a further delay in tightening policy. Comments from central bank officials will also remain under very close scrutiny.

International considerations will remain very important with Sterling tending to be vulnerable when there is a wider deterioration in risk appetite. In contrast, a lack of confidence in the dollar and Euro will maintain the potential for Sterling buying, at least in the short term. The UK currency held above 1.63 in Asian trading on Thursday.

Swiss franc

The dollar was unable to secure any significant advance against the franc on Wednesday and retreated to fresh record lows just below 0.9220. The dollar generally was weak and underling franc demand also held firm in the face of heightened risk aversion.

Middle East fears will certainly ease at times, but underlying confidence is liable to remain very fragile and there is likely to be further underlying franc support. From a medium-term perspective, the Swiss currency may gain additional support from a fundamental distrust of the G7 currencies, particularly if Euro-zone sovereign risk fears intensify.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

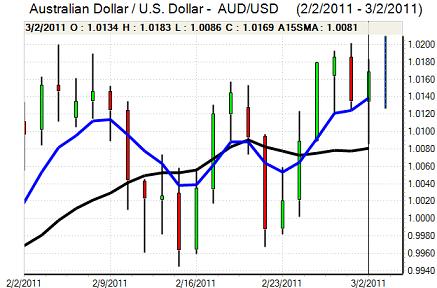

Australian dollar

The Australian dollar found support on dips to just below 1.01 against the US currency during Wednesday and advanced firmly during the US session with a peak close to 1.0180. There was support primarily from US vulnerability, although there was also backing from higher commodity prices.

The domestic data releases offered no support for the currency as there was a sharp 15.9% drop in building approvals for the latest month while the services PMI index remained trapped below the 50 level. There was, however, a solid trade surplus which maintained optimism over underlying commodity exports. The currency found support below 1.0150 as the US dollar remained vulnerable.