EUR/USD

The Euro quickly recovered from lows near 1.3720 against the dollar during Monday and rallied to re-challenge resistance levels at 2011 highs above 1.3840 during the US session with the dollar again generally vulnerable.

The US pending home sales data was slightly weaker than expected with a 2.8% decline for January following a revised 3.2% fall the previous month, but this followed a strong run of releases. The Chicago PMI data was stronger than expected with an increase to 71.2 for February from 68.8.

There were mixed comments from Federal Reserve members with Governor Dudley still cautious over the outlook and suggesting that the Fed would look to complete the quantitative easing programme. In contrast, regional President Bullard stated that he would consider ending quantitative easing early. Bullard is not an FOMC voting member this year and markets will be expecting the Fed to maintain a very expansionary policy.

Testimony from Chairman Bernanke will be watched very closely on Tuesday to assess whether there is any evidence of a change in tone by the Fed chief. Given expectations of a generally dovish tone and there is likely to be a much bigger reaction if there is any hint of a change by Bernanke. Without any change, the dollar will still tend to be undermined by adverse trends in short-term interest rate differentials.

There will be further political negotiations ahead of crucial EU summits regarding bailout terms during March. The scale of electoral defeats suffered by governing parties in recent elections will increase speculation over a harder line over further assistance which will tend to unsettle the Euro. The Euro stalled close to 1.3850 and drifted lower, but there was still solid buying support on dips.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 81.60 against the yen during Monday and pushed to a high near 82. Although resistance levels were tough to break down, the US currency rallied again in Asian trading on Tuesday with a peak near 82.20. There was a stabilisation in risk appetite which helped curb safe-haven demand for the Japanese currency.

The domestic economic data did not have a major impact with household spending dropping 1.0% in the year to January while unemployment held steady at 4.9%.

Bank of Japan Governor Shirakawa stated that the current yen level was not an additional negative factor for the Japanese economy. The comments will tend to dampen speculation over any additional policy easing by the central bank.

Sterling

A break above resistance near 1.6150 against the dollar on Monday triggered fresh buying support for the UK currency and it advanced to a four-month high just below 1.63 in Asian trading on Tuesday as it resisted pressure for a correction weaker with some evidence of month-end flows into the currency.

A stabilisation in international risk appetite helped underpin the currency and it also gained support from a persistent lack of confidence in the other major currencies.

The UK housing data will be important on Tuesday and the PMI manufacturing survey will also be watched very closely given that survey evidence will be vital for the Bank of England in judging their March interest rate decision. The services-sector data on Thursday will probably have a greater impact, but a strong reading for the industrial data on Tuesday would increase speculation over a near-term Bank of England move and underpin Sterling.

Swiss franc

The Swiss franc lost some defensive support during Monday as risk aversion eased to some extent and the Euro was able to advance to the 1.2850 area. Despite wider vulnerability, the dollar was able to resist fresh record lows against the franc and edged back above the 0.93 level.

Safe-haven considerations will remain very important in the near term and the franc will lose support if the Middle East situation stabilises. Markets are likely to remain generally wary and will tend to be cautious over aggressive positioning which will curb franc selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

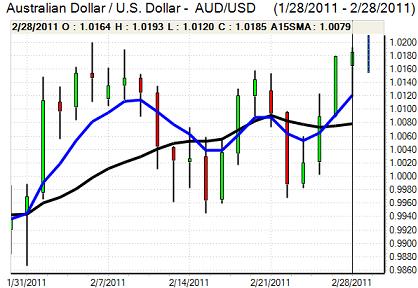

Australian dollar

The Australian dollar maintained a firm tone during Monday and after a brief dip towards 1.0140, the currency moved to challenge resistance levels near 1.02 against the US dollar.

There was no surprise from the Reserve Bank as interest rates were left on hold at 4.75% following the latest council meeting. The retail sales data was also close to expectations with a 0.4% increase for January. There was some relief that the PMI manufacturing index moved back above 50, but there was still a general sense of caution surrounding risk appetite which curbed strong buying for the Australian dollar and it retreated back towards 1.0160 in cautious trading.