The S&P tried to break below the uptrend that’s been intact since Early September. I was hawking the 1296-1298 for a fake out to the downside. Market couldn’t generate any panic but it created a nice trade. I covered my S&P short Wednesday, a bit early around 1305, so that now we can look for the reflex bounce. I went long the SPY yesterday around $130.20. Question now is, what type of bounce will we have? I think we can see 1316 in the S&P today (UPDATE: we hit it while I was writing this), where I will take some more shares off, and then there is bigger resistance around 1323-1325.

Prudent traders should continue to watch oil very closely. With the unrest we are seeing in North Africa and spreading to oil-rich Middle Eastern countries, the oil situation remains very volatile.

Further supply disruptions could trigger another spike in gold prices, which would put the brakes on any market bounce. Gold also fell hard yesterday (although it gapped up today) showing that some think the meat of the fear trade may be over short-term. I’m not inclined to agree long-term, but we could get a 1-2 day relief rally after a tough week for stocks.

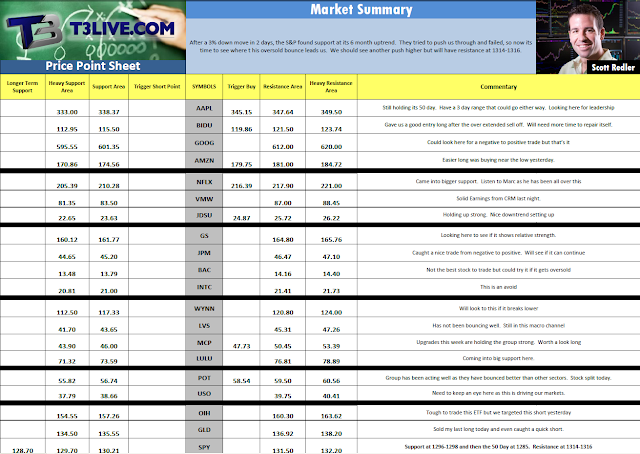

For individual stocks and levels, see my daily Morning Price Point sheet below.

*DISCLOSURE: Long SPY

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.