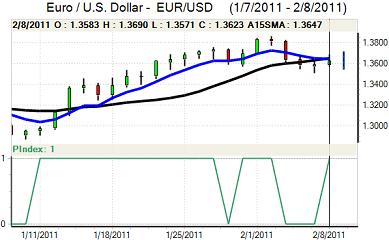

EUR/USD

The Euro found support on dips to below 1.36 against the dollar on Tuesday and had a generally firmer tone, although there was a lack of market leadership amid subdued conditions.

There was a slight fall in the latest US consumer confidence reading, but this followed a big rise the previous month. There was still a feeling of optimism surrounding the economy following recent data and benchmark 10-year Treasury yields rose to a fresh 9-month high above 3.75%.

The Federal Reserve policy response will be a very important short-term focus, especially in view of higher yields. FOMC member Fischer stated that he would oppose any further quantitative easing and there have been other reservations by Fed officials. Markets will monitor comments from Chairman Bernanke very closely later on Wednesday. Any suggestions of a policy shift could provide strong dollar support, although a more cautious line is more likely.

There was a widening of Euro-zone credit default spreads during the day which hampered any further Euro buying support. There are also still very important stresses surrounding the EU countries. There is substantial resistance to competiveness proposals put forward by Germany and France and fears that these measures will be forced through as a condition of providing increased financial support for weaker members. The Euro will remain vulnerable to heavy selling pressure if these tensions erupt and yield spreads widen further.

The Euro pushed to a high just below 1.3690 against the dollar before drifting back to the 1.3650 area as momentum was lacking.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar retreated to lows just below 81.80 against the yen on Tuesday before rallying back to the 82.50 area in Asian trading on Wednesday. The yen strengthened briefly following the Chinese interest rate increase on fears over deteriorating risk appetite, but the impact was measured as other asset classes held steady.

There were further reports of capital repatriation which undermined the dollar initially and there were also fears that forthcoming US Treasury coupon payments will also be repatriated back to Japan which would put upward pressure on the yen.

In contrast, yield considerations remained favourable for the US currency as the dollar’s advantage continues to widen. There were comments from a Moody’s analyst warning over the negative consequences if there is no fiscal reform by Japan, although there were also comments that Japan was still a long way from a crisis situation.

Sterling

Sterling again hit selling pressure above 1,6150 against the dollar on Tuesday and retreated to lows just below 1.6040 before steadying. Previously, weakness had been a function of dollar gains, but this time it was due to a weaker UK currency as it also dipped to lows beyond 0.85 against the Euro.

The government announced a GBP0.8bn increase in the banking sector levy for the coming year which had some negative Sterling impact, especially as there was a retreat in the stock market.

There were only limited data releases with a rise in the BRC shop-price inflation rate to 2.5% from 2.1% previously. The CBI also cut its 2011 GDP growth forecasts slightly

Attention will now focus on Thursday’s Bank of England interest rate decision with further speculation that the bank could decide on a rate increase. There will certainly be a high degree of tension ahead of the decision, especially as it appears inevitable that there will be a split decision and Sterling will spike higher if rates are increased. Volatility is likely to remain a key short-term feature for the UK currency as it consolidated above 1.6050.

Swiss franc

After initially holding steady during Tuesday, the franc was subjected to strong selling pressure during the US session and weakened to lows beyond 1.3150 against the Euro. The Swiss currency also weakened to just beyond 0.9650 against the dollar.

There were reports that franc demand had been eroded by a general improvement in risk appetite, although it looks to have been the case that the move was due more to heavy franc selling by major hedge funds. There is still the possibility of renewed franc support if Euro-zone stresses intensify.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

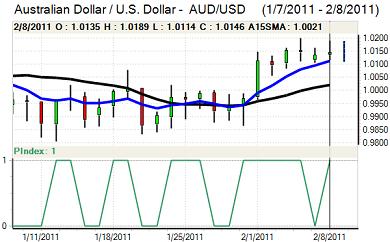

Australian dollar

The Australian dollar hit resistance close to 1.0180 against the US dollar during European trading on Tuesday and weakened sharply to lows near 1.0110 following the Chinese interest rate increase. Despite firm buying support on dips, the currency was again rejected near 1.0180 and retreated in Asian trading on Wednesday.

There was a recovery in consumer confidence according to the latest survey, but there will be caution over the domestic economy. There will also be speculation over further increases in Asian interest rates which would tend to undermine commodity prices and unsettle the Australian currency.