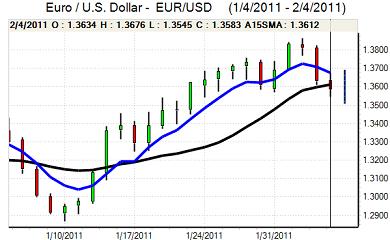

EUR/USD

The Euro held steady close to the 1.3620 area ahead of the US employment data on Friday with narrow ranges an inevitable feature.

The headline non-farm payroll increase was weaker than expected with a gain of 36,000 for January compared with expectations of around 145,000. The report overall was very mixed as the unemployment rate fell sharply again to 9.0% from 9.4% and this represented the largest two-month decline in unemployment for over 50 years. There was also a strong rise in hourly earnings while the headline figure was cut substantially by a census adjustment and the data may also have been distorted by bad weather.

The net suspicion was that the underlying report was stronger than the headline suggested. The other US data has been generally favourable and there was a renewed rise in US Treasury yields during the session. After a knee-jerk decline, the dollar rallied firmly with gains to near 1.3550 against the Euro. Testimony from Fed Chairman Bernanke will be watched very closely this week to assess whether there is a change in tone from the Fed chief.

At the EU summit on Friday, leaders were keen to declare that a framework for a new competitiveness pact had been agreed. Comments following the meeting suggested that there were important policy divisions which will unsettle the Euro to some extent. There will also be major doubts whether any new pact will actually be able to improve the underlying fundamentals and provide a recovery mechanism for countries like Greece and Ireland.

The Euro recovered back to the 1.3620 area against the dollar on Monday, but was finding it difficult regain momentum.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar consolidated just above 81.50 against the yen ahead of Friday’s pivotal US data. There was a brief spike down in the data following the release, but the US currency quickly regained ground as developments in the Treasury market dominated.

There was a firm increase in US Treasury yields which provided important dollar support and it pushed to a high just above 82.40 with evidence of stop-loss yen selling. Expectations of a firm US growth trend should continue to provide underlying dollar support in the near term, but exporter selling will also be a feature.

The trends in Chinese markets and policy direction will be watched very closely following the New-Year holiday period. Any sign of a more aggressive policy tone by the Central bank on inflation and interest rates would tend to undermine risk appetite and could support the yen.

Sterling

Sterling drifted weaker against the dollar ahead of the US data on Friday and dipped to lows just below 1.6050 as the US currency rallied during the New York session. The UK currency recovered on Monday as underlying sentiment was still firm and it also held steady against the Euro.

Interest rate expectations will be extremely important in the near term with the Bank of England due to announce its interest rate decision on Thursday. There will be further speculation that the bank will move closer to or even sanction a rise in interest rates which will tend to support Sterling ahead of the decision.

The British Chambers of Commerce (BCC) stated that the bank should hold rates steady in order to protect the economy and there will be further concerns that any tightening would be damaging. The fact that the BCC is lobbying at all certainly suggests they are concerned that the MPC will raise rates. Overall confidence in the UK economy, Bank of England and Sterling could reverse rapidly.

Swiss franc

The Euro was again blocked just above 1.30 against the dollar during Friday, but was broadly resilient and held above 1.2950. The dollar was able to strengthen to a high just above 0.9580 before a partial correction. There is likely to be some speculation that the National Bank is quietly helping to push the franc weaker even if open intervention is not an option.

Defensive demand for the franc remains lower and the degree of safe-haven support will remain very important for the Swiss currency. Any renewed stresses within Euro-zone bond markets could trigger fresh buying support with volatility still an important risk.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

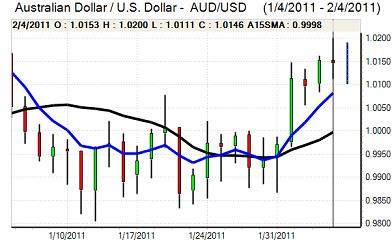

Australian dollar

The Australian dollar hit resistance close to 1.02 against the US currency on Friday and dipped to lows near 1.0110 during US trading before correcting stronger as support levels above 1.01 held.

The headline retail sales data was weaker than expected with a 0.2% increase for January and there was another very weak reading for the PMI construction index, but the job ads data was firm. Markets overall still want to take a positive attitude towards the Australian dollar and there was further solid buying support on dips with a recovery back to the 1.0150 area later in the Asian session.