As a day trader, do you often see a stock gap up overnight through your buy price, effectively ‘taking away the trade’ after you have been stalking it for an intraday bounce? As an investor, do you feel like your portfolio always seems to get a boost to start almost every month? Well, both cases, you’re instincts are correct. The outstanding data-blog Bespoke decided to look into each of these matters a little bit further recently, and the results are intriguing, to say the least.

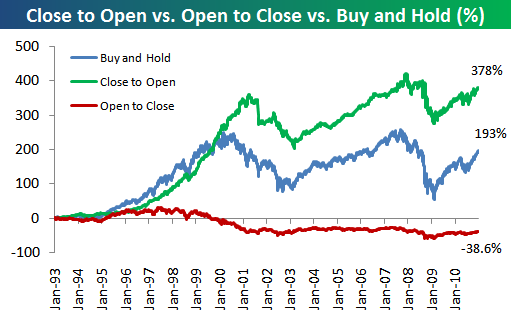

Exhibit A) It turns out ‘night trading’ would be a much more profitable career than day trading. Furthermore, given the results, it would be wise to consider finding some other way to spend your day (i.e. get out of your own way). Take a look at the following chart from Bespoke.

That’s right, since January of 1993 if you bought the SPY ETF on the open and sold it on the close, you would be down 38.6%. If you bought SPY at the start of ’93 and held it until five days ago, you would be up 193%. But the greatest returns, a mind boggling 378%!, would have come if you bought on the close and sold on the open the following day.

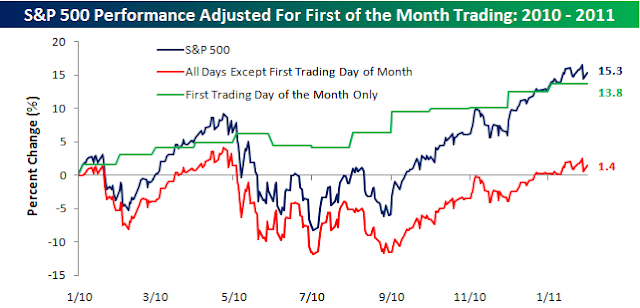

Exhibit B) Another morsel of data from Bespoke that piqued my interest recently was observing market returns on the first trading day of each month, over the course of the last year. A significant portion (more than 90%!) of S&P returns over the last year have been realized during the first trading day of each month. Only two months, June and July 2010, saw declines on the first trading day. Take a look at another chart from Bespoke.

So, based on the historical data from Bespoke (which is, of course, by no means an indication of the future), here’s the plan going forward guys (complete sarcasm, but maybe it shouldn’t be): max out your buying power at the close each day and get flat the next morning on the open. At the end of every month, borrow all the money you can get your hands on from friends, family and neighbors with the promise you will give it back to them at the end of the next day. If they have any questions, just send them the link to this blog post.

*DISCLOSURE: No relevant positions

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.