By FXEmpire.com

A Chinese Slowdown – Yes or No

China’s economy is set to grow 8.4% in the first quarter from a year earlier, according to a senior official with the nation’s economic planning agency, who said the figures were preliminary and based up to the date research.

Zhang Xiaoqiang, vice minister of the National Development & Reform Commission, revealed the gross domestic growth figure Monday to delegates attending a financial forum on Hainan island, and also said consumer prices for the quarter likely rose about 3.5%.

China is set to release official statistics on the size of its economy on April 13 and on consumer prices April 9.

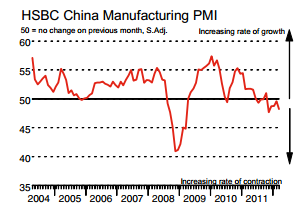

The figure implies a quarter-on-quarter growth rate of 1.6%, or a 6.5% annualized rate, meaning the slowest pace of growth in three years and well short of the government’s 2012 target of 7.5% growth, Credit Agricole said.

The mounting evidence of a deepening slowdown augurs for a cut in lending rates or bank’s required reserves, with a surprise announcement potentially coming as early as this week or more likely sometime before May.

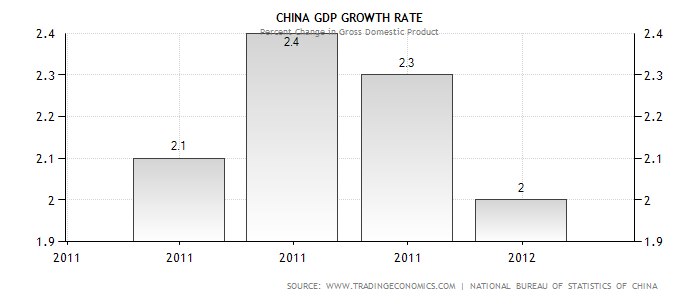

The Gross Domestic Product (GDP) in China expanded 2 percent in the fourth quarter of 2011 over the previous quarter. Historically, from 2011 until 2011, China’s average quarterly GDP Growth was 2.15 percent reaching an historical high of 2.20 percent in June of 2011 and a record low of 2.10 percent in March of 2011. China’s economy is the second largest in the world after that of the United States.

During the past 30 years China’s economy has changed from a centrally planned system that was largely closed to international trade to a more market-oriented that has a rapidly growing private sector. A major component supporting China’s rapid economic growth has been exports growth. This page includes: China GDP Growth Rate chart, historical data, forecasts and news. Data is also available for China GDP Annual Growth Rate, which measures growth over a full economic year.

Just a few days ago, markets were reverberating with warning of a Chinese slowdown and a drop in GDP.

“The Chinese government is trying to manufacture a moderate slowdown,” said Keith Bowman, an equity analyst at Hargreaves Lansdown Stockbrokers in London. “For the time being, investors will take that with a pinch of caution. News of rising fuel prices in China on the back of falling house prices may have damped investor sentiment.”

China, the world’s largest oil consumer after the U.S., yesterday increased gasoline and diesel prices for the second time in less than six weeks after crude last month gained the most in a year. Earlier this month the Chinese government cut its target for annual economic growth this year to 7.5 percent from a previous forecast of 8 percent.

Originally posted here