By: Scott Redler

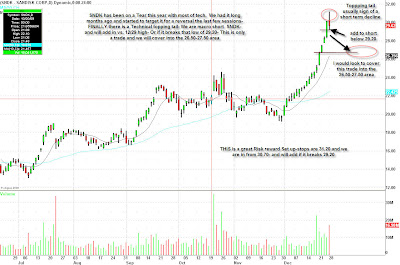

I wanted to post a review of the trade in SanDisk (SNDK). This trade is ultimately the result of several unsuccessful attempts at anticipating a top in the stock’s recent runup. While a trade develops, we enter our positions using small size. As we receive further confirmation in our ideas, only then do we aggressively enter a larger position. Using proper position management techniques can allows us to take small losses while gaining a feel for the stock’s price action and positioning ourselves for a much larger gain when our plan plays out.

Following yesterday’s tail on the daily we had a clear signal that upside momentum was waning in SNDK. With that in mind, I was looking to add to the short either at yesterday’s resistance or through its lows. In the chart below, you can see the setup for today’s trade.

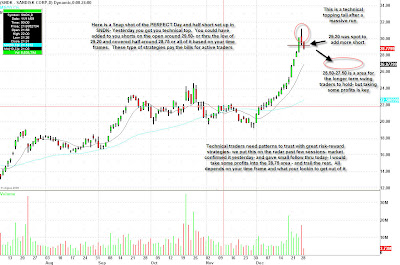

Now take a look at the chart after today’s move. Once price moved through yesterday’s lows, we saw further selling pressure come into the stock. The technical signal provided confirmation that our initial idea would begin to work as a trade.

We took some profits in the $28.75 area and will leave some room for the rest of our position to run. What started as an intraday trade can turn into a nice swing trade. However, it is still prudent to take profits along the way and lock in gains at target levels.

We took some profits in the $28.75 area and will leave some room for the rest of our position to run. What started as an intraday trade can turn into a nice swing trade. However, it is still prudent to take profits along the way and lock in gains at target levels.