By FXEmpire.com

A Difference of Opinion in Chinese Economic Reports

There seems to be two contradictory opinions of the recent PMI reports from China.

The Government data release and the data survey by HSBC and Markit.

By Government reports, Chinese manufacturing gained momentum for a fourth straight month in March, helped by a recovery in the vehicle, tobacco and electronics sectors, although analysts said conflicting data suggest lingering weakness.

The state-affiliated China Federation of Logistics and Purchasing said on Sunday that its purchasing manager’s index, or PMI, rose 2.1 points to 53.1 in March, up from February’s 51.0 and January’s 50.5. A reading above 50 signifies expansion.

The rise in new factory orders suggests a recovery in some industries, but federation analyst Zhang Liqun said there were still worrying signs of weakness in exports, investment and consumer demand.

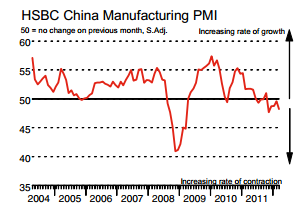

That was evident in a second set of data, from Markit and HSIBC, which said that after adjusting for seasonal factors, its PMI index for China for March was 48.3, down from 49.6.

The world renowned Market PMI index, which tends to reflect trends in the export sector more strongly than the official index, has remained below 50 for five straight months and recorded its lowest average reading in three years in the first quarter.

A final report from Markit put the index at 48.3 for March, down from 49.6 in February. This reading has been below 50 for five months.

The 50 level marks the difference between the manufacturing sector expanding or contracting.

Markit’s report noticed weakness in several key areas:

A) Reduced factory output reflects falling new business from home and abroad

B) Manufacturing employment down at sharpest rate in three years

C) Input price inflation ticks higher, but remains modest overall

The government data released on Sunday showed signs of contraction in the textiles, specialized equipment manufacturing and metals industries.

China faces a challenge in keeping growth from stalling while avoiding an inflationary rebound, especially given this year’s surges in oil prices.

Chinese economic growth declined to 8.9 per cent in the final quarter of last year after Beijing lifted interest rates and tightened other controls to cool inflation.

In December, Chinese leaders reversed course and promised more bank lending to help companies cope with the slump in global demand, but changes have been gradual. Most of the recent reports from China have reported below forecast or have had lackluster results, building negative sentiment towards Chinese growth. The debate is really whether it will be a soft landing or a hard landing for China and her neighbors.

Originally posted here