Well, I ended up having to work on something this morning between 7-9:30am and was not able to do any prep for market open. One side benefit of trading is that normally a project like that would of taken up like 5 hours but I really wanted to get back to trading today so I worked fast – and the end product was just as good as if I had spent twice as much time on it!

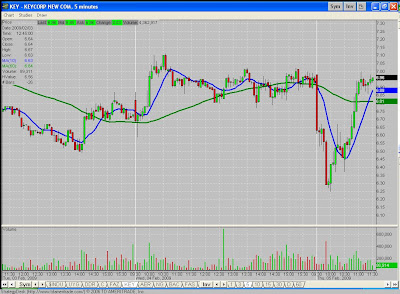

I was watching the market tank in the AM, but didn’t want to chase shorts. So I was looking for a dead cat bounce and maybe a full reversal. That did happen, but with the morning stall, at the time, I was never fully convinced things would rebound as much as they have by the time I’m writing this now. So I was a little hesitant all morning and my reflexes were rusty. I tried to enter one trade – KEY around mid morning. It had long green candles on the five minute chart, the overall market was moving up, and it crossed $6.50 strongly. I tried to get in on a pullback, but my $6.49 order didn’t get filled (even paper trading) and the price bounced a dime quickly so I was weary of chasing.

I have this working theory that I’m considering making as my #1 rule: Only enter long trades when there are tall green candles above the 10-SMA on the five-minute chart and enter shorts on long red candles under the 10-SMA on the five-minute chart. Coupled with the other Muddy signals, this type of set up seems to pan out more often than not.

If I had got a fill on this trade, its very possible I would of exited because the stock whipsawed a lot for about a half hour, see that long wick right before it exploded up. It got as low as $6.37, which would of been a $120 loss with an entry at $6.49. But if I followed my rule of not exiting a position until a long candle fully crosses the 10-SMA in the wrong direction confirmed with a 10/60 SMA cross on the 1-minute chart – if I stuck with that exit guideline, then this stock has the potential to go to $7 – which was my price target and recent support from yesterday turned to resistance level today. Tomorrow I should be able to get all my screens set up and my watch lists running a couple hours before the market opens to get several trades in.