By FX Empire.com

A Quick Look at Current Events from Emerging Nations

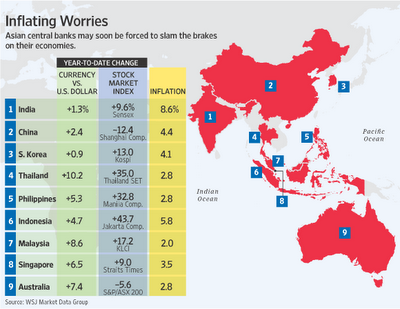

This week has been overshadowed by the Greek crisis and its affects on trading partners. Asian markets have been largely overlooked on the whole. There have been some unusual events taking place.

The markets caught the headlines through out the week, The RBA held rates, surprising the markets. BoJ held rates doing what the markets expected. Economic reports were mostly at forecast. New Zealand unemployment fell below forecast. Most overlooked were the emerging nations.

Emerging Asian currencies may suffer more profit-taking in a near term as China’s January-February data is likely to stay weak on annual basis due to the Chinese New year

China’s imports in January shrank by 15.3 percent from a year ago — the lowest since August 2009, data showed earlier.

What we are seeing is saturation point for the recent bullish trend. If we see more negative trade and economic data, we will see more correctionsThe rupee has lost nearly 2 percent against the dollar so far this week, heading for its largest weekly loss since the week ended Nov 20, according to Thomson Reuters data. Last week, it recorded a fifth consecutive week of gains, the longest streak of appreciation in more than 15 months.

The Singapore dollar was next in line, having shed 0.9 percent versus the greenback after gaining for four weeks.

Offshore investors on Friday also took profits from emerging Asian currencies against the euro.

The market players had built up long positions in the regional units versus the single currency as Asia’s economic and fiscal fundamentals are stronger than the euro zone.

Investors expect emerging Asian currencies to see some more corrections, but the long term outlook is still positive.

China’s trade surplus widened more than expected in January amid a sharp drop in imports, although analysts cautioned against alarm, saying the data may reflect holiday-related distortions rather than deterioration in underlying economic trends.

China’s trade surplus totaled $27.3 billion for the month, according to data reported Friday by the state-run Xinhua news agency, outpacing expectations for a $10.6 billion surplus according to a poll compiled by Dow Jones Newswires.

Imports for the month were down 15.3% from a year earlier, while exports contracted a 0.5%, according to the Xinhua-reported figures. Despite repeated pledges by China’s top leaders that they will stick to their two-year-long property-tightening campaign, expectations of various forms of easing have surfaced after the Chinese central bank said Tuesday it will support financing for social housing projects and first-time home purchases.

It remains unclear whether Wuhu’s move has the central government’s blessing but analysts said the city’s measures, which were designed to support purchases of smaller-size apartments and property for self-use only, have the potential to be replicated by other cities.

Housing sales in China have plunged in recent months as home buyers have taken to the sidelines in anticipation of further declines in prices thanks to Beijing’s tightening campaign.

The average sale price of homes in Wuhu city was CNY5,567 per square meter last month, down 0.25% from a month earlier and 5.7% from the same period a year earlier, according to private-sector data provider, China Real Estate Index System.

Bank Indonesia may cut interest rates further if the global economy worsens and domestic inflation continues to ease, Deputy Governor Hartadi Sarwono said Friday. The central bank unexpectedly cut its policy interest rate by 25 basis points

Vietnam’s Prime Minister Nguyen Tan Dung ordered the central bank to “solve” within the first quarter a shortage of funds among lenders, stepping up pressure on policy makers to fix banking risks threatening the economy.

The deadline to remedy “liquidity problems” in the banking system was given in a resolution on the government’s website. The prime minister also instructed the central bank to closely monitor the market in order to reduce lending interest rates to “suitable” levels at a “suitable” time.

Vietnam’s dong climbed for a second day on speculation demand for foreign currencies will weaken as the nation’s imports slow and the trade deficit narrows. Government bonds fell.

The country’s trade gap shrank to $100 million from a revised $269 million in December, as imports declined to $6.6 billion from $9.36 billion, according to preliminary data released Feb. 2 by the General Statistics Office in Hanoi.

“The trade deficit has been gradually narrowing in recent years,” researchers Tai Hui, Jennifer Kusuma and Thomas Harr at Standard Chartered Plc in Singapore wrote in a report Wednesday. That means “more support for the Vietnam dong, at least in the short term,” they wrote.

The currency rose 0.2 percent, to 20,913 as of 2:56 p.m. local time on Wednesday, headed for the strongest close since Jan. 30, according to prices from banks compiled by Bloomberg. The central bank fixed the reference rate at 20,828, unchanged since Dec. 26, according to its website. The currency is allowed to trade up to 1 percent on either side of the rate.

The Bank of South Korea unanimously decided to leave its key interest rate for an eighth consecutive month. The decision was in line with what the market had been expecting.

The Korean monetary authority has chosen to remain cautious in recent rate decisions because of a slowing global economy that may affect South Korea, which is very open to international trade. In fact, South Korean exports tend to be used as an indirect measure of the status of the global economy.

The key lending rate was left at 3.25% as Korean authorities continue to highly weigh inflationary pressures. The latest Consumer Prices Index figure came in at 3.4%, below the 4% target. The market expects inflation to move above the target over the next 12 months if demand from China and the United States holds steady.

Originally posted here