These last several months have made life much easier for me as a stockpicker. Yes, I am an options trader but I prefer to buy options of individual names and not the indices, nor do I play the futures much. My stock picking ability starts and ends with the charts and technicals. My studying and research can put me in a position to make some very nice gains – and it has happened so far in 2013 (knocking on wood) – but the environment has been more than accommodating to my style.

When we talk about market correlation this is about how stocks react to overall market moves. When the correlation is high we find stocks move with the market regardless of news, facts, chart patterns or technicals. Remember the days in 2011 when volatility was high and rising? The SPX would plunge 20-30 handles without much effort, and no matter what news hit stocks just got blasted. Or, perhaps the futures would gap higher and run hard all day, taking everything along with it – burning the short sellers like they were just off a hot barbecue.

Ah, those were the days of uncertainty, high anxiety and fear. What happened to those days? Well, as we said about correlation, the chart below tells the story. Simply put, the $JCJ says market correlation is very low stocks move on their own merits. We’ll have some go up, some go down and some just move sideways. Those with an edge in stock picking will generally outperform the rest.

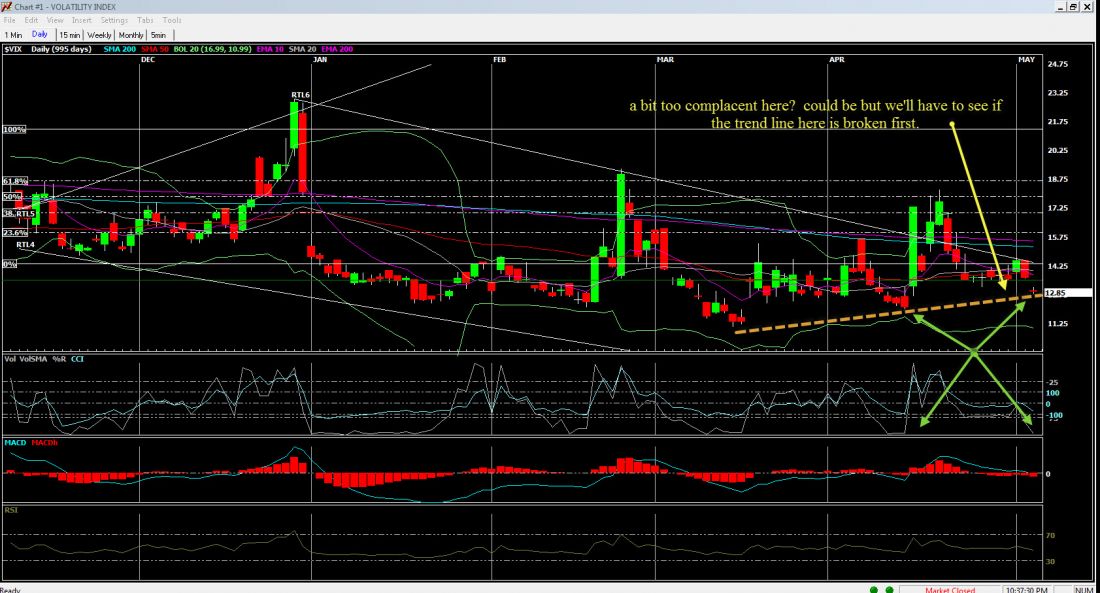

Sentiment has clearly been an issue of late. I wrote recently about the ‘wall of worry‘ and how if it continues to be up the market may very well keep on going. The VIX as a measure of volatility has shown there is little to fear of a major move on the horizon. The futures curve continues to reflect a bullish bent and until that changes there is but one way to go: PICK STOCKS.