Trends in markets move in moves. While nothing in markets is perfectly predictable, there is a regularity to the rhythm of a market that is not difficult to see. When this regularity is disrupted, traders holding with-trend positions should be careful—trends can end suddenly and violently.

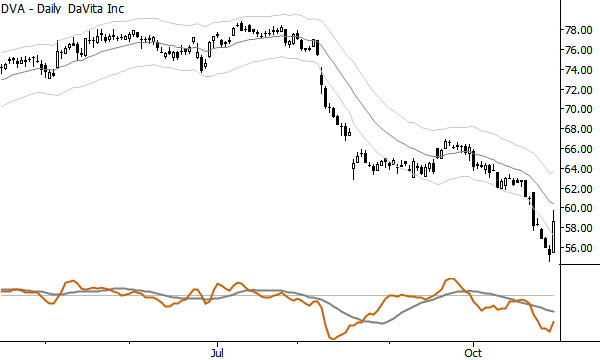

DaVita (NYSE: DVA) provides a good illustration of this concept. This stock peaked in 2015, and began its most recent strong decline in mid-summer 2016. A look at the chart shows a selloff interspersed with some periods where the stock went sideways, bounced a bit, or sold off in stair step patterns. The details of these formations are not significant, but the overall concept and tone of the selling is significant.

However, something changed yesterday—we’ve seen something that we have not seen in many months in this stock: a single, large upward close. One way to evaluate moves in markets is to consider them on a volatility-adjusted basis, and, if we do this, Monday’s rally in DVA is the strongest (at 4.0σ) since May 2016. This type of rally is not consistent with a downtrend and should be put shorts on warning—if you hold shorts, you do not short into such a rally without confirmation, you may look to tighten trailing stops on your position, or you may move to the sidelines altogether.

There’s always a tendency to want to dig into the news to know what is driving such a move, but I would argue it doesn’t matter—the market has already done the analysis and work and has distilled it into a price movement. This is the beauty of a disciplined technical system: we can accept the market’s moves for what they are and manage appropriately. In this case, the DVA has told us that something may have changed for the shorts, and we should watch developing action carefully over the next few days.