By: Scott Redler

Friday we saw some buyers come support Big Cap tech, but for the first time there was no real follow-through off the open. Apple (AAPL), Amazon (AMZN) and Google (GOOG) all sold off hard early on. While I wouldn’t ring the warning bells just yet, these moves are cause for concern. Prudent traders must exercise increased caution considering the latest market action. We will be watching Google as it approaches the 50-day moving average.

not to be alarmed, but let’s be noticed. 208/209 in apple, if that breaks, that can add some fuel. GOOG we’ll be watching around the 50 day moving average, see how it reacts. Since breaking the 50-day in July, Google has consistently traded above this key moving average, without even a single test. This first test will be very significant in assessing the health of the uptrend in Big Cap Techland. Apple needs to hold the $208-209 area. If not, it could trader lower pretty aggressively.

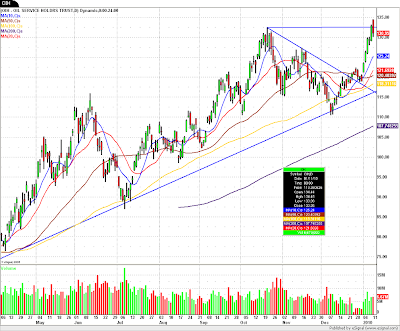

This morning we had some good risk/reward RedDog Reversal setups in the Oil Service Holders (OIH) and U.S. Steel (X). Each had extended runs coming into the weekend, and each gapped up above its most recent high. The trade back through that prior high triggered our short entry, with a stop at the intraday high. Aggressive traders could have entered a second tier as prices failed to confirm the breakout above the October high of 127.94.