Last Week

Before we could get started on our Easter holiday last week, we had to “labor” through the March Non-Farm Payroll report, due out at the crack of dawn (on the USA west coast), but on a day when the stock market was closed, for Good Friday observance. The futures however, were trading for about 45 min. post report, so the setup was there for the market to sell off.

Oh, I know you could probably call me a “Monday morning QB” for saying it now, but it really seemed ready to break regardless of the impact on the economy. The futures dropped sharply, and before the Easter eggs were passed out, the futures were down 1%! If long the market, what a miserable start to the long weekend.

But as we lamented over the weekend, it turned out the reaction was not all that bad – just the perception from the futures response. In fact, Friday was very thin trading, not many on their desks to trade – and who would be buying in front of a long weekend?

So, come Monday a.m., with the report in the rear view mirror, the buyers were ready to take advantage – and boy did they! Since the close on Thursday, 4/2, the SPX 500 is up close to 1%, and that occurred on some very impressive turnover. Those looking for the markets to move southbound have been stymied – again.

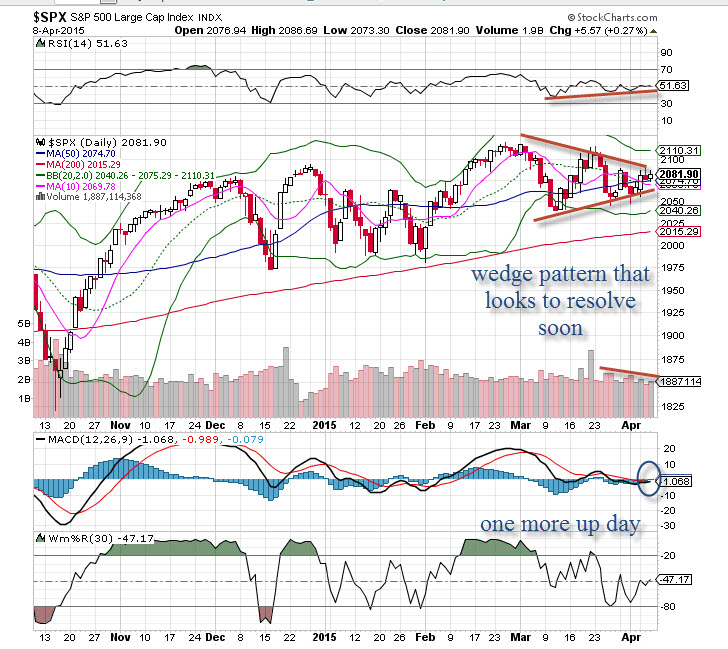

Yet, since a mid February breakout, the index has made no progress, just chopped inside a wide range (see chart below).

Next Week

As we embark on a big earnings season, this could be a pivotal moment for equity investors, as they keep an eye on the Fed and what their next move is likely to be. Given the way the equity markets handle perceived bad news (like the jobs report), we could see this resolve once again to the upside.

For more from Bob Lang, please click here.