The Golden Sunrise

The essential morning read for investors!

Today’s Golden Sunrise

Wednesday, April 21, 2010

Hours of research consolidated for you

An Apple report day keeps the QQQQ and NDX healthy

Asia was modestly positive last night without better gains from the Kospi in South Korea up 1.72% and Taiwan up 1.14%. Both are tech heavy and had a boost from Apple’s reported results.

Apple was down about $2 on the down but exploded after hours trading as high as $265 before settling in the $257s up $13+. This stock is over 16% of market-cap weighted NDX and is expected to give it a boost today. Europe is mostly negative this morning and the S&P and the Dow are as well…the Nasdaq is positive so far. Question is whether this last escalation is a blow off top or will we retreat a bit, build a base and go higher. Apple has more great products in the pipeline and it is hard to doubt anything they do.

This will open with a big gap up.

There were a lot of companies that reported stellar results yesterday, many in the tech space, so the XLF and QLD might have big days. Still, the rise from February 5th is bordering on historical (and the shorts are hysterical) so a pullback is in the cards somewhere.

Altera up 194%, Apple us 86%, Coach (the market for $600 minimum handbags has recovered-whew, that’s comfort), up 31, Coca-Cola 231%, Cree a plus 262% and is set up nicely in the space that provides the new light-bulbs, GILD 56%, Godly Goldman Sachs 65.9, JNPR 58%, PLXS up 21%, AOS up 248%, Tupperware 68%, and Yahoo 66.

In after-hours, the market took some up and some down…doesn’t matter what you did..it matters what you did compared to what was expected. Will make for an interesting day today.

Not-so-goods were ALGT down 183%, EAT 73, HOG 46.1 (not a command just the order they were listed in), STT -27.9, SVU -28.7, USB off 19.2, and WFT down 77.8%

Priced for perfection so many were brutalized on disappointment.

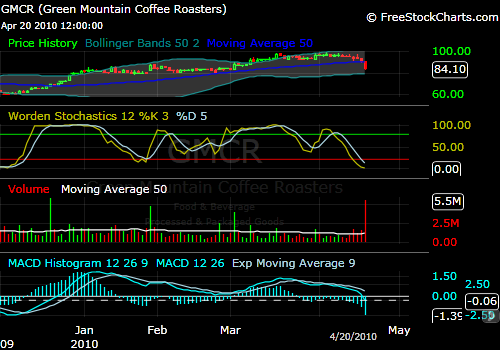

A former #1 of IBD not many moons ago is Green Mountain Coffee Roasters…which rose and rose and rose..through any and all conditions..

The next day or two is going to support or rebuke last Friday’s sell-off. It has pushed distribution days on the Dow, the S&P500 and the NYSE to 5 and the Nasdaq to 3.

It was options expiration day, which is normally high volume.

- At 8.1 Billion on the NYSE it was 1.6 billion than opex days have been running.

- The down volume on the NYSE was 13-1 over gainers.

- Maven Marty Zweig uses 9-1 as a key level.

- The Nasdaq was 5.3 to 1.

- Stocks with A rated accumulations totaled a new high 1004 on Friday.

- That same category only had 705 yesterday, dropped 241 on Monday alone (over 24%) as somebody left Dodge.

- Block trades on NY were 19,282 last Wednesday, 18,943 on Thursday and dropped to 13,178 on Friday despite 2 billion share increase in trading volume. Very curious.

Germany had an amazing day yesterday although you wouldn’t know it looking the etf for Germany. The DAX was up 101 points, almost 2%, as all 30 stocks were green…led by huge increases in the automakers.

This despite the Grecian formula for disruption. A cheap Euro actually helps exports but German consumer confidence which I reported yesterday skyrocketed and took the market with it.

Loose change:

The UK reported better than expected employment data this AM

- India has banned cotton exports (to keep costs down for its’ mills)

- CB of India raised interest rates and the reserve reqs by ¼ point.

- New highs on US markets yesterday were 468, new lows 8.

- 45 of the new highs were medical related

- Canada raised its 2010 GDP forecast to +3.7% from 2.9%

- Canadian dollar now costs $1.0017 US

- The IMF is proposing not just one but two taxes on banks and wants to make sure it goes worldwide so there are no havens. Coupled with all the discussions of VAT for the US it is clear that we will be bombarded with “tax increase talk” so that higher taxes is no longer the issue, just which one we choose. Joseph Goebbels has taught the modern propagandist well.

Gold has been in a trading range for a while so which way it breaks could be interesting. Same for silver…usually these metals are flat in early April, jump into a May and then sink to buying opportunities in the summer months. We’ll see.

Despite that pattern, the Russians bought 500.000 ounces in March. What do they know, the Russians are only sitting on the 3rd highest total of cash reserves behind China and Japan.

The US mint has sold 43,580 gold eagles so far this month and 1.756,000 silver eagles as demand in this country is smashing all the previous records. Canada sold 9.727,552 Maple Leafs last year which was multiples of former records and this in a country with an appreciating currency.

Please don’t buy any so the price stays down and I can buy for less. No way hyperinflation could ever happen in the civilized, modern world so those paper dollars, yen, yuan, euros, zeros, will always be as safe as the integrity of the politicians and bankers that keep generating more.

Goldman Sachs says the fab Fabrice Tourre acted alone. He has been suspended with pay…until a job with a sovereign government opens up would be my guess.

Don’t chase markets.

JohnR.

Goldensurveyor.com

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!