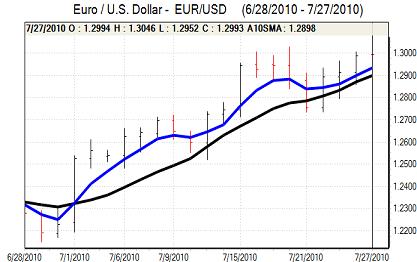

EUR/USD

The Euro maintained a robust tone in early Europe on Tuesday and pushed to challenge resistance levels above 1.30 against the dollar. The European economic data again provided support with German consumer confidence rising to 3.9 in the latest month from a revised 3.6 for June, maintaining the recent run of favourable data. There was an annual increase in Euro-zone money supply for the first time since January. Risk appetite was also firm which helped underpin the Euro and it pushed to an 11-week high close to 1.3050.

The US housing data was slightly stronger than expected with the Case-Shiller house-price index recording a 4.6% increase in the year to May. In contrast, the consumer confidence data was weaker than expected with a retreat to a 5-month low of 50.4 for July from a revised 54.3 as confidence in the labour-market deteriorated.

There was some weakening in risk appetite following the US data which also provided some dollar support as there was a retreat in high-yield and commodity currencies as oil and gold prices fell sharply. There was also a measured retreat in emerging-market currencies which curbed dollar selling and curbed Euro support.

There were reports of central bank Euro selling at higher levels, notably from the Swiss National Bank and this helped push the Euro back to below the 1.30 level later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Asian equity markets were generally firm on Tuesday which lessened defensive yen demand with gains for the Australian currency also triggering demand for carry trades. The dollar drifted just weaker than the 87 level during the session with demand for both currencies weaker as the US currency found it difficult to gain any yield support.

Markets will remain on high alert for comments and potential verbal intervention from Bank of Japan and Finance Ministry officials if the dollar slides towards the pivotal 85 fundamental and technical area against the Japanese currency.

The dollar was able to find support below 87 later in the session and strengthened to a high close to 87.95 in New York as the yen lost support on the crosses. The Euro strengthened to a 10-week high above 114 against the Japanese currency.

Sterling

Sterling continued to challenge resistance levels above 1.55 against the dollar in European trading on Tuesday. After an initial technical failure to break through there was a retreat to the 1.5450 area.

The latest CBI retail sales data was much stronger than expected and this triggered a fresh surge in the UK currency. The survey recorded a figure of +33 for July from a figure of -5 previously and retailers were also optimistic over the August outlook. Although distorted to some extent by methodology changes, the figure was a four-year high and Sterling was able to break convincingly above 1.55 with a peak above 1.5580 during US trading. There was also a peak close to 0.8335 against the Euro.

Sterling also proved broadly resilient in the US session even when there was a measured deterioration in risk appetite following the US data and this does suggest that underlying demand for Sterling has increased, although sentiment could still reverse rapidly.

Swiss franc

The Swiss currency continued to retreat against the Euro on Tuesday and hit a 5-week low close to the 1.38 level during the European session. Franc weakness on the crosses inevitably had an important impact on the franc against the dollar with the US currency strengthening to a high of 1.0640.

Underlying franc demand remained lower during the session as confidence in the Euro-zone economy and financial sector remained firmer. The franc was also unable to secure a significant recovery when risk appetite faded, although a bigger test for global investors will come if equity markets decline sharply.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

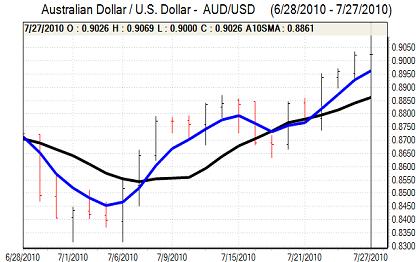

Australian dollar

The Australian dollar maintained a robust tone during local trading on Tuesday and strengthened to a high close to 0.9070 against the US currency. Underlying risk appetite remained broadly firm during the session which provided initial support.

There was some pressure for a correction after recent gains and buying support also faded during the session. There was a significant decline in gold and commodity prices which stifled Australian currency support. As risk appetite also deteriorated to some extent in US trading, there was an Australian dollar decline to test support close to the 0.90 level.