Back in late June, fast-casual restaurant chain Noodles & Co (NDLS) captivated the IPO market with its phenomenal debut. It didn’t take long for the IPO market to generate another huge winner from the food industry. On August 1, natural and organic food grocer Sprouts Farmers Markets (SFM) followed suit by pricing its IPO at $18 vs. the $14-$16 projected price range and opening 94% above its IPO price.

Its impressive start didn’t exactly come as a shock, though. The natural and organic food space has been red-hot, as evidenced by recent IPOs Natural Grocers (NGVC), Fairway Group Holdings (FWM), and The Fresh Market (TFM), which have put in gains of 140%, 100%, and 145% versus their respective IPO prices.

Further, SFM’s financials are impressive, highlighted by its 25 consecutive quarters of positive same store sales growth and its peer-leading revenue growth rates. The question now, however, is whether SFM is still a good buy following its meteoric rise.

A CLOSER LOOK AT SPROUTS

For a little history, SFM opened its first store in Chandler, AZ in 2002 and then in 2011 it combined with Henry’s Holdings which operated 35 Henry’s Farmers Markets stores and eight Sun Harvest Stores. It didn’t stop there, however, as it acquired Sunflower Farmers Market and its 37 stores in May 2012.

SFM is located primarily in the southwest U.S, concentrated in Texas, Colorado, Arizona, and California. With 163 stores as of July 19, 2013, it is one of the largest organic grocers in the country. For the sake of comparison, Natural Grocers (NGVC) has 65 stores and Fairway Group (FWM) has 12 locations.

Its stores are typically smaller in size, averaging 27,500 sq ft, and they have a “farmers market feel”, with an open-air atmosphere. The economics of its new stores look pretty favorable as it targets cash-on-cash returns of 35-40% within 3-4 years after opening.

FINANCIALS AND VALUATION

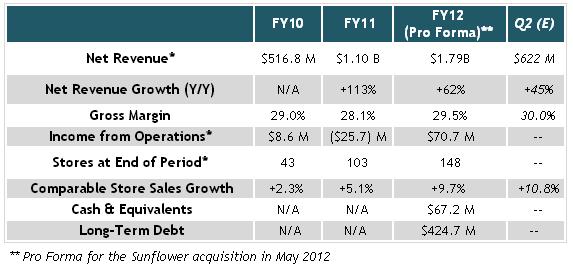

Looking at its financials, it’s easy to understand the enthusiasm for this deal. Revenue growth has been exceptional with sales surging 113% in FY11 to $1.1 billion, followed by 62% growth in FY12 to $1.79 billion.

This has been driven by a combination of new store launches – primarily via its acquisition of Sunflower Markets last May – and solid same store sales growth of +5.1% in 2011 and +9.7% last year.

Another positive is that SFM is profitable, generating $70.7 million in operating income in FY12, and its margins have been on the rise. Gross margin most recently came in 29.5% for FY12 and it projected that gross margin ticked up to 30% in 2Q13.

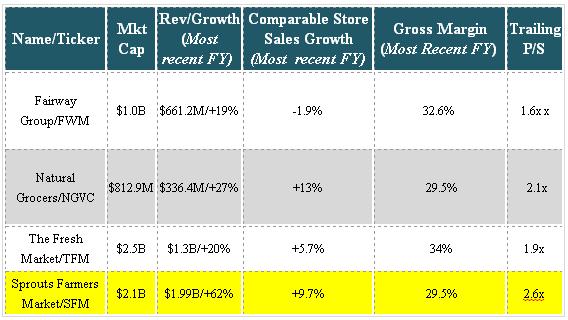

What really sealed the deal, in terms of its stock nearly doubling on its first day, was its valuation. At $15/share, the mid-point of the proposed price range, its trailing P/S would have been 1.1x FY12 revenue. That would have been well below that of NGVC’s 2.8x and TFM’s 2.0x. Its’ strong pricing and huge open, however, gave it a premium valuation.

SFM VERSUS THE COMPETITION

Overall, SFM stacks up quite well against these recent organic grocer IPOs — all of which have been big winners. SFM’s revenue growth rate far exceeds all of these companies, thanks largely to its acquisition last year of Sunflower Farmers Market. But, it’s comparable store sales also compare favorably, only slightly lagging NGVC.

As we noted above, its upside pricing and its surge when it opened for trading did lift its valuation to premium levels. Based on its superior financials, though, it could be argued that SFW warrants higher multiples.

TRADING STRATEGY

With a 130% gain thus far, SFM’s astounding debut makes it one of the year’s top-performing IPOs – and with good reason. As consumers have demanded healthier food options, natural and organic food grocers have clearly benefitted. This is evidenced by SFM’s 25 straight quarters of positive comparable store sales growth. The company is also demonstrating confidence regarding the strength in the market through its plans to grow its store count by 12% annually over the next five years.

In other words, SFM’s future looks bright. On the downside, its valuation is rich and is no longer the positive attribute it was prior to its IPO. Additionally, with the stock rocketing higher, some IPO investors may look to flip out of the stock to lock in profits.

Therefore, while we like SFM’s fundamentals and believe the stock could move even higher longer term, we do believe that it may be prudent to wait for a pull-back as a better entry point may be forthcoming.

= = =