Air Products & Chemicals (APD) is a $27 billion industrial gas supplier headquartered in Allentown, Pennsylvania. They hired Seifi Ghasemi to take on the chairman and CEO role this summer, following more than a decade in the same position at Rockwood Holdings (ROC). In September they announced the company will be reorganizing by geography instead of divisions by products. This could result in the company selling assets unless gross margins in the underperforming divisions improve. Bill Ackman of Pershing Square Capital Management has been pushing for a shakeup at the company since last year. The fund currently is the largest shareholder with a 9.65% stake.

Valuation

The stock trades at a P/E ratio of 19.79x (2015 estimates) with 11.3% EPS growth, price to sales ratio of 2.49x, and a price to book ratio of 3.35x. Revenue growth is expected to pick up from 3.2% in 2014 to 5.9% next year. While investors wait for the restructuring to be completed, Air Products & Chemicals has been a steady dividend payer for years (currently yield of 2.44%).

Unusual Options Activity

On October 15, someone rolled out 2,500 Nov $135 calls (credit) into 2,500 Nov $125 calls (debit). He/she initially bought the Nov $135 calls for $3.90 each, but due to the correction in the overall stock market the stock and calls have been hit (sold for $1.50 each). Despite the loss on the Nov $135 calls the large trader is committing more capital to the Nov $125 calls (paid $6.00 each or $1.5M in call premium) ahead of Q4 earnings on October 30. The call to put ratio was 11:1. Call activity was over two times the average daily volume. Implied volatility rose 6.3% to 37.28. Also, on July 18 and July 21, there were a combined 4,000 Jan 2016 $140 calls purchased for $8.75-$8.90.

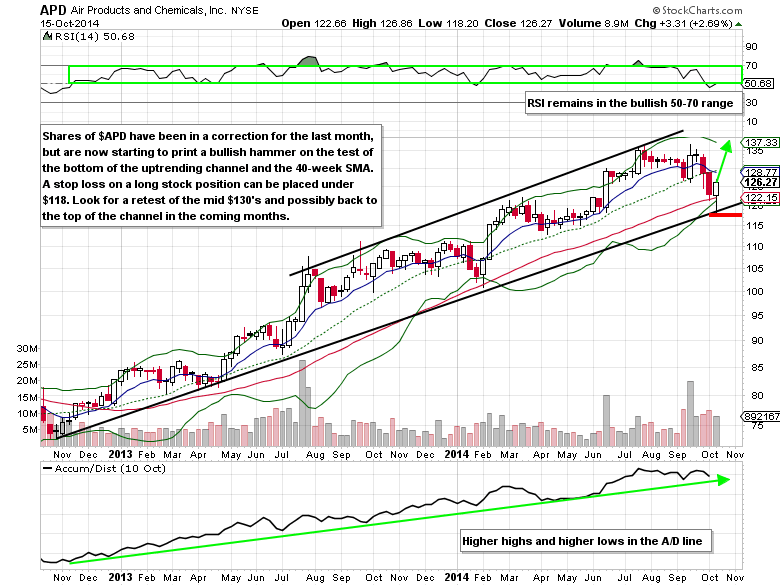

Technical Analysis

Air Products & Chemicals Options Trade Idea

Buy the Nov $125 call for $6.50 or better

Stop loss- $2.90

First upside target- $10.00

Second upside target- $15.00

= = =

Learn more about Warren’s work at Options Risk Management here.