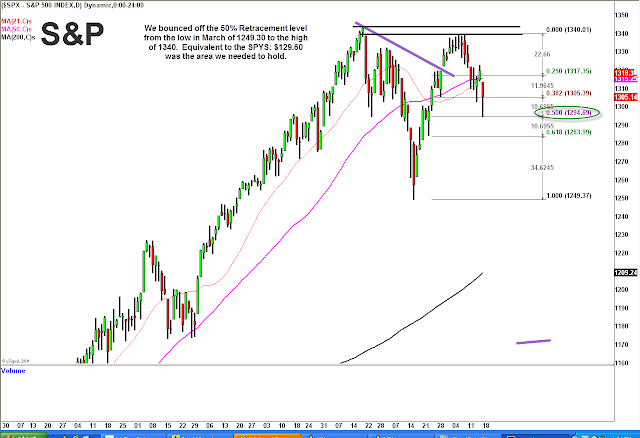

US stock futures point marginally higher Tuesday as earnings season heats up and investors continue to digest the US debt outlook revision from S&P. Yesterday we saw major technical damage as the market fear the possibility of more extensive austerity measures following the S&P warning. Stocks were able to bounce back somewhat in the afternoon, and will look to build on those gains today. The S&P held the 50% retracement from the March low to 1340 resistance, and $129.60 was the line in the sand for the SPDR S&P 500 ETF (SPY). Moody’s and others disagreed with S&P’s assessment of US debt, so its certainly possible investors could shrug off the warning if Washington does not make a knee jerk reaction.

On the earnings front, Goldman Sachs Group Inc. (GS) and Dow component Johnson & Johnson (JNJ) are set to report this morning. GS will try to reverse the fortunes of a troubled banking sector, which has continued to lag the market this year. Goldman in particular has gotten slammed over the past few weeks after accusations from Washington that they mislead investors and that CEO Lloyd Blankfein lied to Congress. It will take a very strong report to lift Goldman and the group, and to this point other bank earnings have disappointed. (UPDATE: Goldman posted a blowout quarter of $1.56 (adj.) vs. $0.82 exp and $11.9B vs. $10.2 exp. The stock is up about two points right now.)

For more commentary watch the T3Live.com Morning Call below with Scott Redler and Debra Borchardt (below).

While the market was under heavy pressure yesterday, some favorite momentum names held up well and pushed higher as the market lifted. In yesterday’s Morning Call we highlighted yoga apparel maker Lululemon Athletica, inc. (LULU), which broke out to new highs. Today, we are watching its cousin Under Armour, Inc. (UA) for a similar move. UA touched the lower end of its upper consolidation yesterday before going green, and should follow-through today on any market strength.

The other main highlight of yesterday’s Morning Call was Wynn Resorts, Limited (WYNN) long as it looked to hold the breakout from Friday. The casino group leader was one of the strongest stocks in the market Friday on options expiration, and was a place to turn once the market regained strength yesterday. However, with WYNN extending to new highs already, there is perhaps a better set-up in the casino sector with Las Vegas Sands Corp. (LVS). LVS had a very big day yesterday, but technically is just coming into a long-term downtrend line and should gain momentum on a break above. Las Vegas Sands is a leader in Macau, the destination driving casino growth at this point.

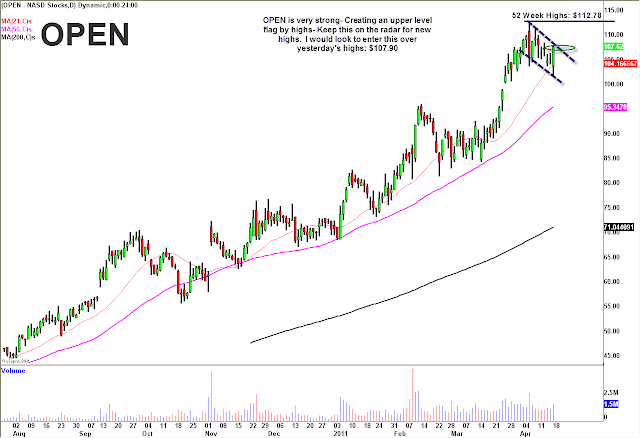

Another high flying momentum stock that looks good technically today is OpenTable Inc (OPEN). The online restaurant reservation service and restaurant operations streamliner has been in a mini-downtrend flag over the past two weeks and started to break out of it yesterday. OPEN carries a lofty valuation but so far investors continue to show demand for this hot stock.

Finally, after an impressive snap back intraday yesterday, we have to mention Apple Inc. (AAPL). The stock has been acting poorly since Steve Jobs’ leave of absence began, and weakness was compounded by index rebalancing that saw Apple’s weighting cut. Yesterday AAPL plunged below major support at $326.26 in early trading, but rallied back hard the rest of the day to close more than 1% higher. Apple has built on those gains this morning and looks like it could break out of its nearly month-long downtrend. The stock remains tremendously undervalued in our eyes, and that of most analysts who have price targets in the $450 range.

*DISCLOSURE: Scott Redler is long AAPL, POT, GLD, CYD, OIH, MGM, LVS, REDF, WEBM, HAUP, BIDU, SOHU. Short SPY, SLV.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.