An Apple (AAPL) a day keeps the doctor away. That’s the old adage, right?

Personally, I prefer to eat mine with extra crunchy peanut butter, JIF if possible. Well, for the third time in a 30 day period, I am ready to purchase more AAPL. And, not Granny Smiths, either –but some call options.

GOOD ODDS

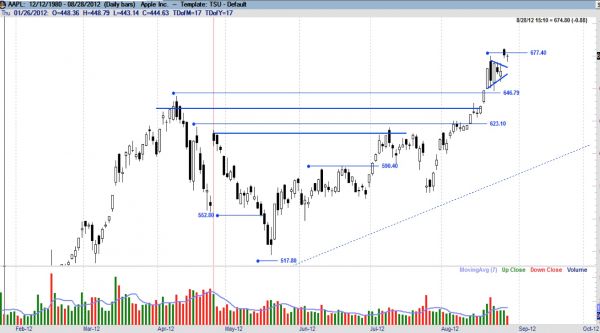

I think that AAPL has a high probability trade at this point. Earlier this month, I entered a bullish trade at $624. I immediately waited through four days of a pennant-type continuation pattern with textbook declining volume. I was able to sell at my target of $635, based on a resistance line.

CONTINUATION PATTERN

On August 8 and August 15, we formed what looked much like a “rest after battle” candle pattern (a continuation pattern), and closed above the previous all-time high of $644 with good volume. I went bullish at $646 with a target of $669, based on a simple Fibonacci extension.

SET-UP

I believe that we are continuing the bullish trend, and I am setting up my re-entry. Let me explain my thinking. Recently, we had another pennant pattern with declining volume and a gap coming out of it. I refer to the most recent candles as downright “pathetic.”

SHOOTING FOR $700

Additionally, a lot of buyers want to see AAPL reach $700, and rightfully so. Though I don’t recommend trading the news, it doesn’t hurt its bullish probabilities that AAPL recently won a major lawsuit against Samsung.

MOMENTUM

As far as indicators go, the stochastic and MACD are trending and the relative strength indicator (RSI) is sitting right above overbought, as indicated by my nifty blue line. However, looking at the RSI historically on AAPL, there is room for it to go much higher.

GETTING IN

To enter this trade, I am looking to enter the day after we have a close above $677 with a target around $699, again based on a Fibonacci extension. To manage my risk, I would feel comfortable placing my stop around $656, which is below the 10-period exponential moving average (EMA) and the low of Tuesday, 8/28/2012, which was being supported by the 5-period EMA.