The week is nearing an end with Apple (AAPL) continuing to weigh down the Nasdaq (NDX).

This isnât a surprise as weâve been warning about the Apple decline for several weeks. Now we are seeing the typical buy the rumor, sell the news activity in Apple and many were caught âlong and wrongâ overnight on Tuesday, expecting to cash in on a potential pop toward 550 +/-50.

AVOID HOPE AND FEAR TRADES

We try to avoid trading on hope or fear and rely on our Decision Support Engine (DSE) for support and guidance. Our DSE shows that Apple has reached the 50 and 200 day moving averages around 465, likely having exited the 500â²s until after the stock tests 300 +/-25 in the coming year.Â

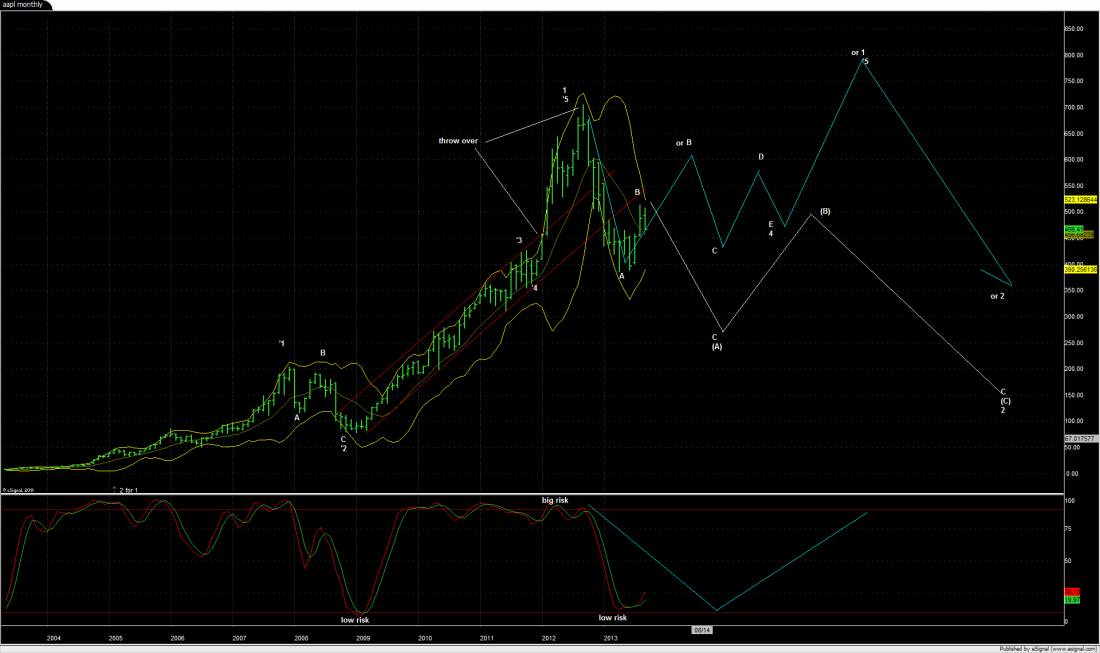

Hereâs the chart weâve shown throughout the past 18 months,here the white path has likely been chosen by the herd, but canât be known for certain yet. You can see in the chart where we were following the wave count in blue and got short on the corrective bounce our DSE had been projecting in August.

Now the news is out and we have a cheaper (deflationary) iPhone available. The herd mentality appears to be taking over and switching gears to the white path, but we wonât know for certain until we see prices below 400.

THE TRADE

Our Apple Jan â14 420 puts (purchased at 12.95 and 7.30 â we sold the 7.30s Thursday @12.30 for $5/contract profit) will play this reversal into the end of the year, as 385 is broken on the way to 300 +/-25. The same thing happened last summer as prices exploded through the 600â²s, where DSE got us out of longs/into shorts into the 7 peak, before prices fell into the vacuum of â1000 before 600″ certainty, and reversed all the way to 385.

= = =

Read Jeff York’s pivot point analysis on Apple here. He’s bullish. Are you bullish or bearish? Don’t be shy. Post a comment below.