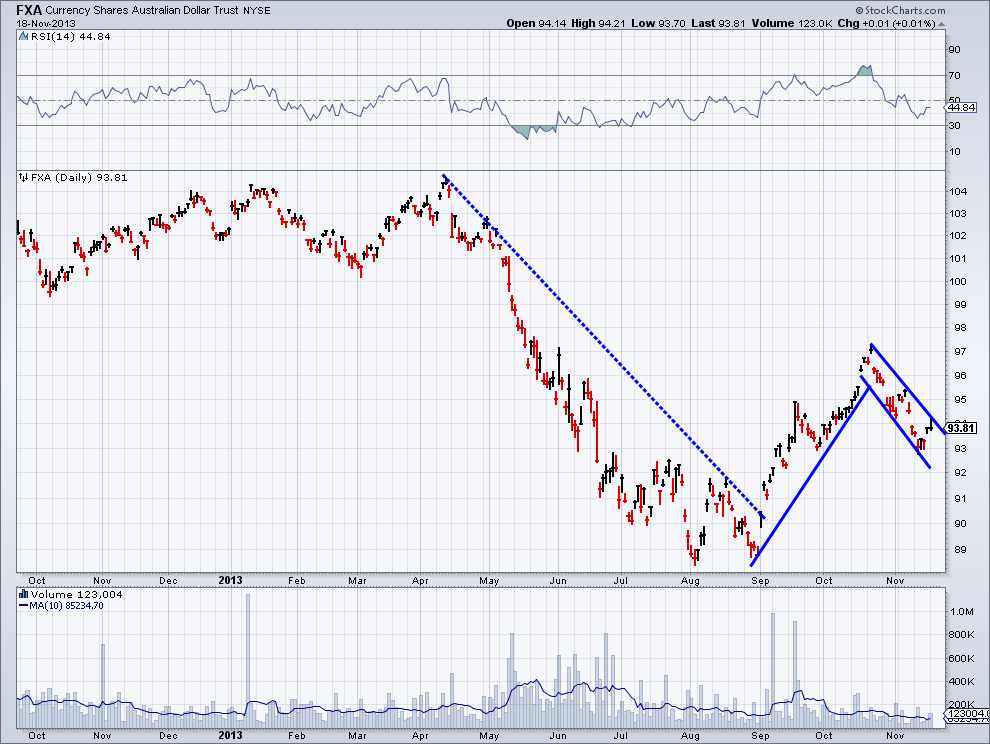

The Australian Dollar has been an interesting currency to watch this year. From the April high we saw the Currency Shares Australian Dollar Trust (FXA) fall a little over 14% to its potential bottom in August. During this move lower I began to notice that momentum was beginning to diverge – as the price of FXA headed lower, the Relative Strength Index was heading higher. I often discuss these types of setups but one critical step that I look for is confirmation. You can see the dotted line in the chart below that shows the down trend from April to August. The positive divergence that was being created in momentum gave us more conviction in the trend change in September.

The most recent price action in FXA is what I’d like to focus on today. We have what’s called a flag pattern, which is often considered a pattern of continuation for the previous trend. The short-term up trend in FXA from September to late-October acts as the flagpole and helps create an estimated target if the flag pattern breaks to the upside. The flag itself is created in the narrow channel that’s taken place over the last month. Like a Head and Shoulders pattern, volume is important to monitor when reviewing a flag setup. In the chart I’ve overlaid a 10-day moving average of volume to give a better idea if volume is rising or falling during the creation of the flag. For FXA volume has been slightly dropping, which helps confirm that we are in fact seeing a flag pattern being setup.

We can’t know how long price will trade in this narrow range but when it eventually breaks out volume can be a great tool to confirm the price action. Until one of the channel lines has been violated, patience will be key in monitoring the Aussie Dollar.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.