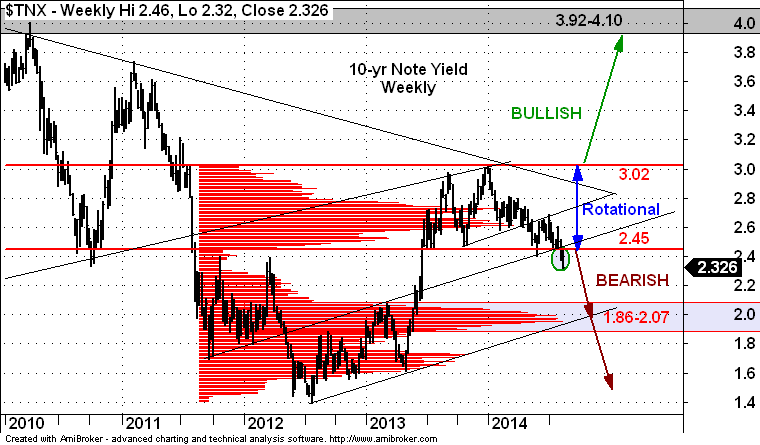

As interest rates have churned sideways over the last year, we’ve heard plenty of opinions on where they are going next. With the big move up in 2013, the majority of opinions that we’ve seen are calling for higher rates on the horizon.

At i10 Research, we let the charts do the talking and the chart of the TNX, which is the 10-year interest rate, shows that rates are not headed higher. They are moving lower. The trend in interest rates has been bearish since the start of 2014 and has now broken key near-term support.

The break of 2.45, which was an area of support for nearly a year, signals that rates are moving down and the next area of support that we are targeting is 1.86 – 2.07.

Only a move back above 2.60 would negate the immediately bearish bias and sway our opinion away from lower interest rates dead ahead.

= = =

See more research from i10 Research and receive a 30-day free trial.