It’s very interesting when we see that a market keeps hitting all time new high levels. This is the case of the Nasdaq-100 index. The tech index has been a great go-long trade these past few months as the price has kept on shooting higher.

However, every upswing must stall at some point. Here are some reasons that support the possible pullback on the NDX.

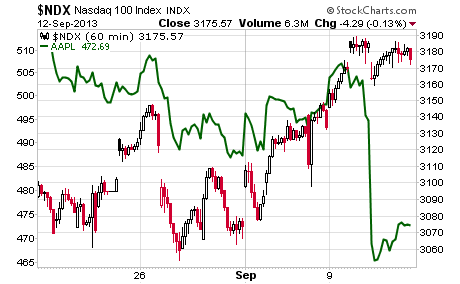

NASDAQ 100 VERSUS AAPL

On this first chart, based on a 60-minute scale, we can see how the positive correlation between Apple, Inc. (AAPL) and the Nasdaq-100 (NDX) has been dented.

After unveiling their two new iPhone models on September 10, AAPL share price took a big hit. Most investors are concerned that the cheaper model (iPhone 5C) could be too expensive to gain traction in the low cost segment. This was followed by a wave of rating cuts and downgrades, pushing the price further away from the $500 mark.

This doesn’t help our go-long trade in the Nasdaq-100 as Apple’s weight on this index is still quite high.

DANGER SIGN AHEAD

On the Vantage Point chart we can see how the Short Term Predictive moving average is closing in on the 5-day simple moving average on the downside. This is our first warning signal for a possible upcoming drop.

Along with that, the Williams Electronic Market Accumulation Index is starting to show a distribution effect on this index. This is our second warning signal.

BOTTOM LINE

Although the price is holding at these levels and could continue rising and attempt to test the 3.200 level, one has to be careful as the first signs of an upcoming drop are already here.

Also keep in mind that the FOMC announcement is coming up soon and it could trigger strong moves in either direction.

Whatever strategy we decide to use, it’s recommendable to keep stops in place and preserve capital. I am sure that after the FOMC announcement we will see a clearer picture and can go long if the price keeps pushing higher or instead we could play the drop with a reverse ETF such as ProShares UltraShort QQQ (QID) which is two times inverse the Nasdaq-100 index.

= = =