By FXEmpire.com

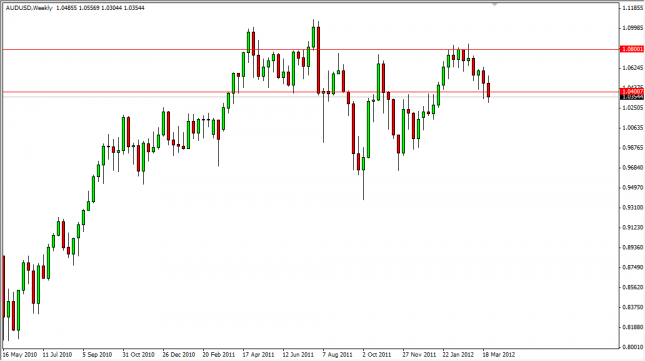

The AUD/USD pair fell again over the previous week. Concerns of a slowdown in China have prompted fears of a global slowdown as well, and with the US being one of the few economies seemingly ready to move forward, a rise in the value of the US dollar against the currency of a country that supplies China with its raw materials makes sense.

The pair is finding support in the 1.03 to 1.04 level, and this area is important to the future of the pair. The commodity trade should continue to be a major factor in the future of the Aussie. The current area simply must hold for the bulls to have something to hang onto as the market has been selling off so relentlessly. The weekend has China PMI numbers coming out, and depending on how those come out, we could see drastic moves in this pair.

We are currently waiting to see some kind of supportive candle, or better yet – a daily close above the 1.04 level. At this point in time, we would be willing to go long and aim for at least 1.08 or so. The pair pays a nice swap in order to wait as well, so we can be patient in our trade as it moves forward. The downside simply has far too much in the way of noise for us to get involved with, no matter what happens at this point.

The Aussie is almost always a “buy only” pair unless we have serious financial panic, in which it can drop drastically in short order. However, unless the Chinese numbers over the weekend are poor, we simply don’t see a meltdown coming. In fact, each time this pair falls, the first thing you have to be thinking is “Where is it going to find support?”

We are buyers of this pair; buy only over the 1.04 mark on a daily close. Until then, we are simply waiting patiently as we know that over time this pair tends to run to the upside in long stretches.

AUD/USD Forecast for the Week of April 2, 2012, Technical Analysis

Originally posted here